For the 24 hours to 23:00 GMT, the EUR rose 0.69% against the USD and closed at 1.0883.

On the macro front, Germany’s Ifo business expectations decreased to a level of 79.7 in March, as the spread of coronavirus weighed on economic activity and compared to a level of 93.4 in the prior month. The preliminary figures had recorded a fall to 82.0. Additionally, the Ifo business climate declined to a level of 86.1 in March, reaching its lowest level since July 2009 and compared to a reading of 96.1 in the previous month. The preliminary figures had indicated a fall to 87.7. Furthermore, Ifo current assessment fell to a level of 93.0 in March, compared to a reading of 98.9 in the previous month. The preliminary figures had recorded a fall to 93.8.

In the US, the MBA mortgage applications plunged to 29.4% on a weekly basis in the week ended 20 March 2020. In the previous month, mortgage applications had recorded a fall of 8.4%. On the other hand, the housing price index rose 0.3% on a monthly basis in January, in line with market anticipations and compared to a rise of 0.6% in the prior month. Additionally, durable goods orders unexpectedly rose 1.2% in February, due to growth in orders for transportation equipment and confounding market forecast for a fall of 0.8%. In the previous month, durable goods orders had recorded a revised advance of 0.1% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0916, with the EUR trading 0.30% higher against the USD from yesterday’s close.

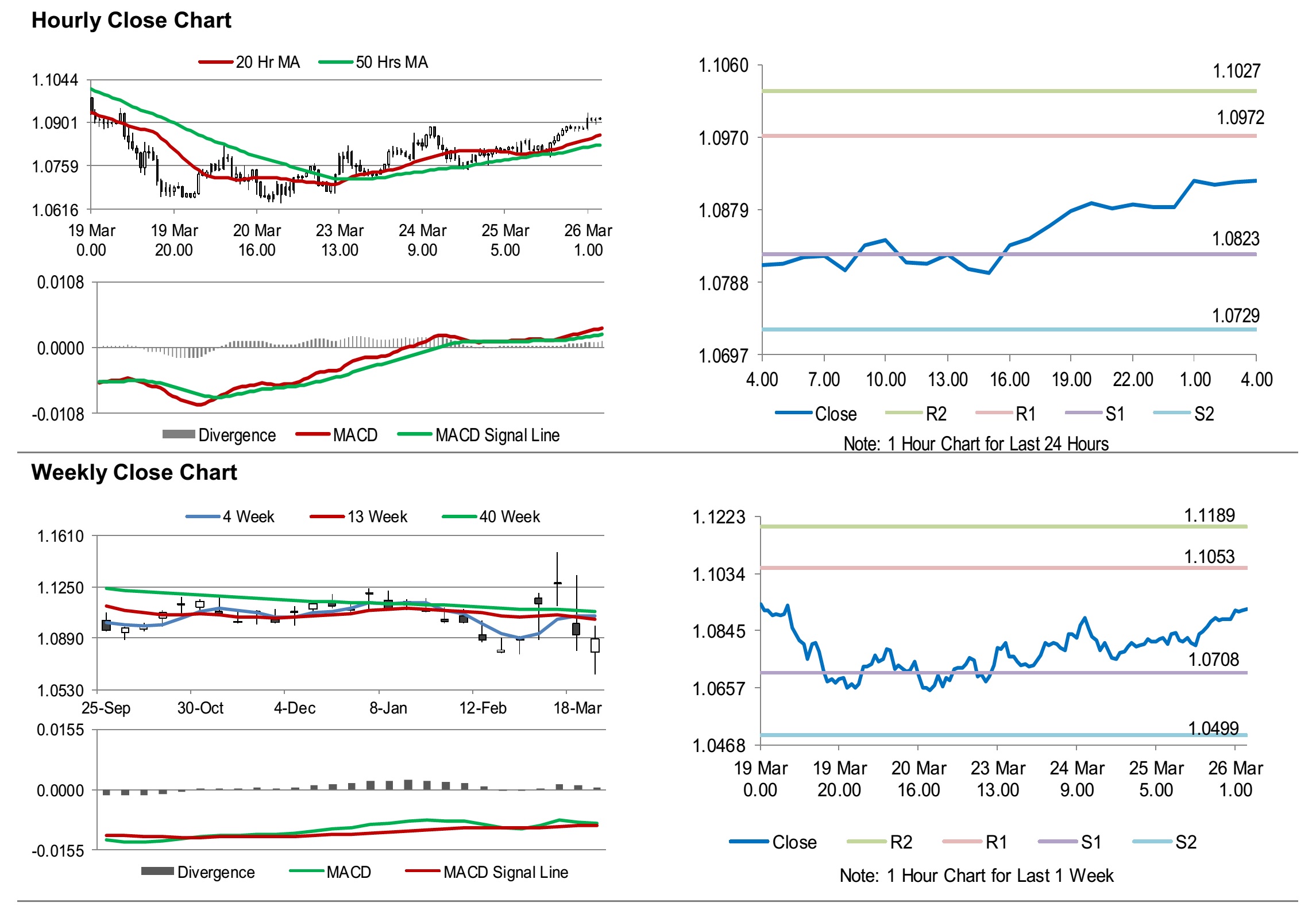

The pair is expected to find support at 1.0823, and a fall through could take it to the next support level of 1.0729. The pair is expected to find its first resistance at 1.0972, and a rise through could take it to the next resistance level of 1.1027.

Moving forward, traders would keep a close watch on Euro-zone’s M3 money supply for February and Germany’s GfK consumer confidence index for April, slated to release in a few hours. Later in the day, the US goods trade balance for February and annualised gross domestic product (GDP) for 4Q, along with initial jobless claims, would pique significant amount of investors attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.