For the 24 hours to 23:00 GMT, the EUR rose 0.06% against the USD and closed at 1.0919.

In the US, the NFIB small business optimism index advanced to a level of 104.3 in January, as business owners were confident that sales would continue to rise and help support higher profits. In the prior month, the index had registered a level of 102.7. Meanwhile, the JOLTs job openings unexpectedly declined to a 2-year low level of 6423.0K in December, signalling weakness in the job industry and compared to a revised reading of 6787.0K in the previous month.

Separately, the US Federal Reserve (Fed) Chairman, Jerome Powell, in his testimony before the Joint Economic Committee of Congress, stated that the Fed has not contemplated plans for further interest rates cuts, unless economic conditions were to change significantly. Moreover, the US economy appears to be resilient to global headwinds, with economic activity increasing at a moderate pace, however, the central bank is continuing to watch developments regarding the coronavirus and its impact on global growth.

In the Asian session, at GMT0400, the pair is trading at 1.0915, with the EUR trading slightly lower against the USD from yesterday’s close.

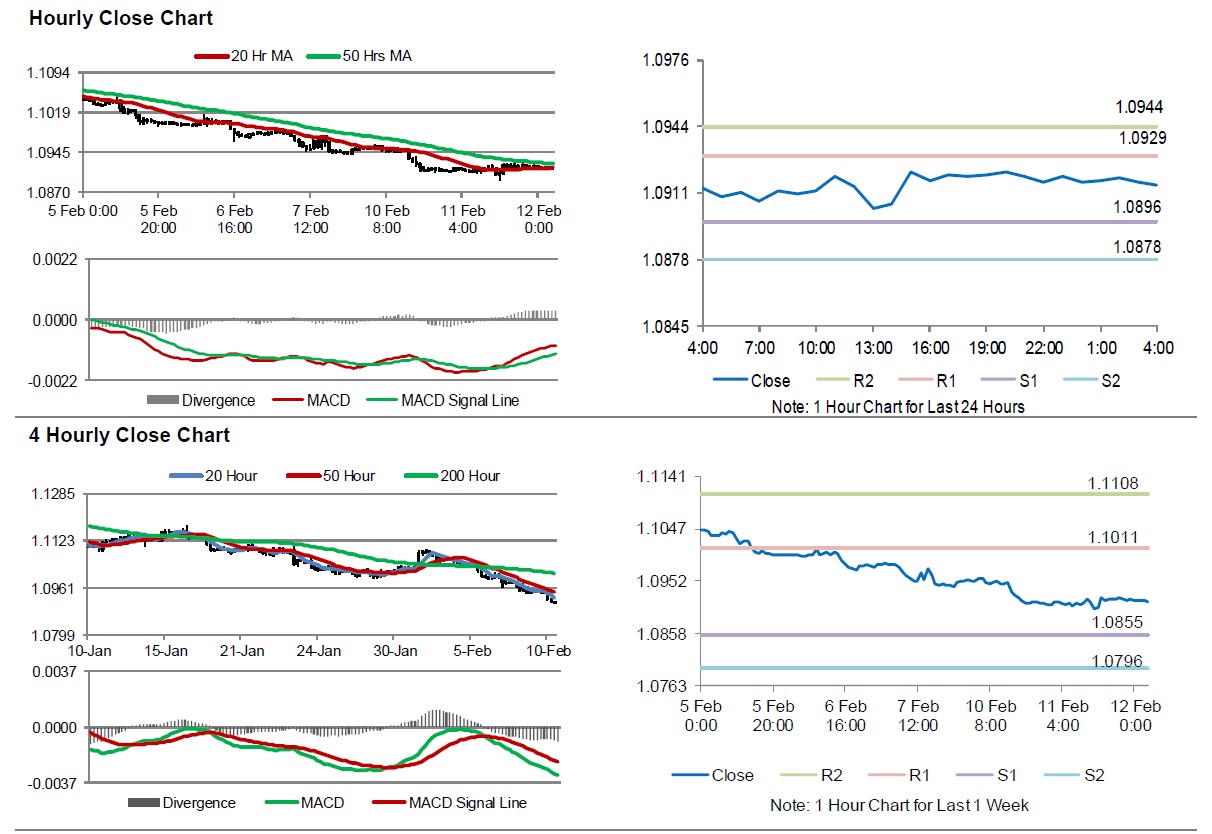

The pair is expected to find support at 1.0896, and a fall through could take it to the next support level of 1.0878. The pair is expected to find its first resistance at 1.0929, and a rise through could take it to the next resistance level of 1.0944.

Looking ahead, traders would keep a close watch on Euro-zone’s industrial production for December, slated to release in a few hours. Moreover, the US MBA mortgage applications followed by the monthly budget statement for January, scheduled to release later in the day, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.