For the 24 hours to 23:00 GMT, the EUR declined 0.16% against the USD and closed at 1.1375.

The US dollar rose against a basket of currencies yesterday, amid reports that the US is planning to impose additional tariffs on Chinese goods.

In the US, data showed that the Dallas Fed manufacturing business index unexpectedly advanced to a level of 29.4 in October, compared to a reading of 28.1 in the prior month. Market participants had envisaged the index to record a steady reading. Moreover, personal spending rose 0.4% on a monthly basis in September, in line with market expectations and rising for the seventh consecutive month. Personal spending had recorded a revised rise of 0.5% in the previous month. Meanwhile, the nation’s personal income climbed 0.2% on a monthly basis in September, marking its lowest gain in 1-year and undershooting market consensus for a rise of 0.4%. In the preceding month, personal income had recorded a revised gain of 0.4%.

In the Asian session, at GMT0400, the pair is trading at 1.1382, with the EUR trading 0.06% higher against the USD from yesterday’s close.

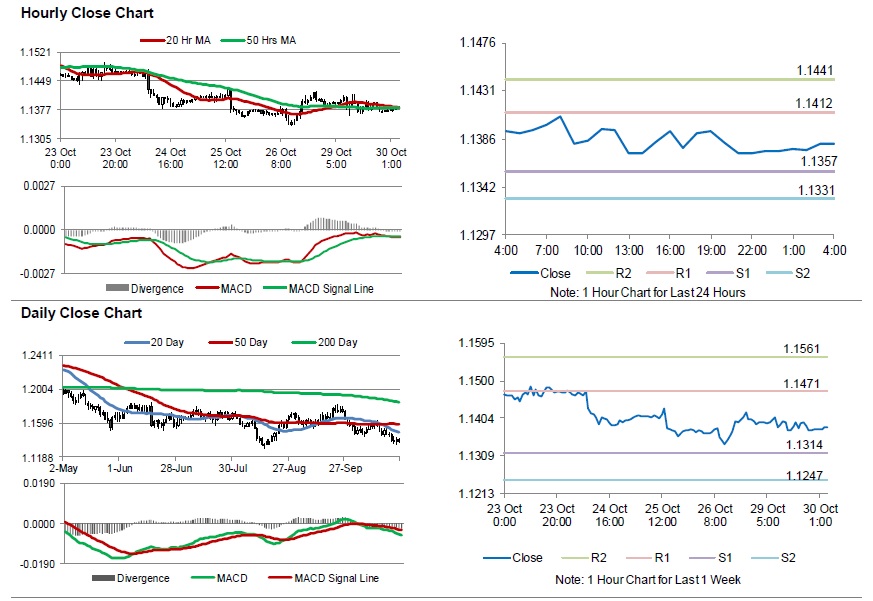

The pair is expected to find support at 1.1357, and a fall through could take it to the next support level of 1.1331. The pair is expected to find its first resistance at 1.1412, and a rise through could take it to the next resistance level of 1.1441.

Looking ahead, traders would closely monitor the Euro-zone’s 3Q gross domestic product, followed by the economic confidence, business climate indicator and consumer confidence indices all for October, slated to release in a few hours. Additionally, Germany’s unemployment rate and the consumer price index, both for October, will keep investors on their toes. Later in the day, the US consumer confidence index for October, will garner significant amount of investors’ attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.