For the 24 hours to 23:00 GMT, the EUR declined 0.25% against the USD and closed at 1.1367 on Friday.

On the data front, Euro-zone’s seasonally adjusted current account surplus narrowed more-than-expected to €20.30 billion in November, compared to a revised surplus of €26.80 billion in the previous month.

In the US, data showed that the US industrial production advanced 0.3% on a monthly basis in December, higher than market expectations for a rise of 0.2%. Industrial production had registered a revised climb of 0.4% in the previous month. Moreover, the nation’s manufacturing (SIC) production rose to a 10-month high level of 1.1% on a monthly basis in December, boosted by gains in automobile production and beating market expectations for a gain of 0.3%. In the prior month, manufacturing production had recorded a revised rise of 0.1%.

On the other hand, the US preliminary Reuters/Michigan consumer sentiment index declined to a level of 90.7 in January, falling to its lowest level since October 2016 and amid mounting worries over nation’s economic growth. In the preceding month, the index had registered a level of 98.3, while market participants had anticipated the index to fall to a level of 96.8.

In the Asian session, at GMT0400, the pair is trading at 1.1374, with the EUR trading 0.06% higher against the USD from Friday’s close.

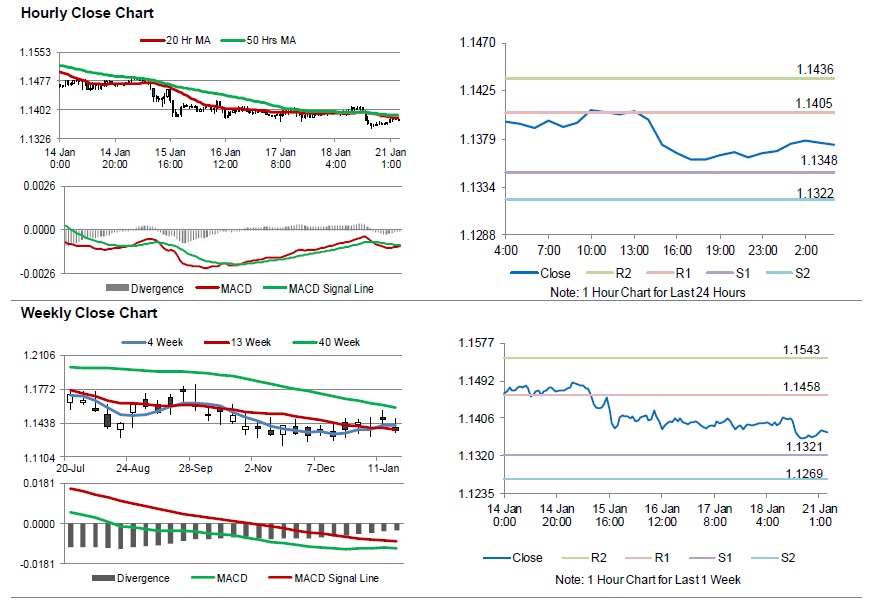

The pair is expected to find support at 1.1348, and a fall through could take it to the next support level of 1.1322. The pair is expected to find its first resistance at 1.1405, and a rise through could take it to the next resistance level of 1.1436.

Trading trend in the Euro today is expected to be determined by Germany’s producer price index for December, scheduled to release in a while.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.