For the 24 hours to 23:00 GMT, the EUR rose 0.15% against the USD and closed at 1.0909.

On Friday, data indicated that the Euro-zone’s flash consumer price index (CPI) climbed more-than-anticipated by 1.9% on an annual basis in April, jumping back to the European Central Bank’s (ECB) target of just below 2.0%. Markets expected the CPI to advance 1.8%, following a rise of 1.5% in the prior month.

Separately, Germany’s retail sales unexpectedly climbed 0.1% MoM in March, compared to a revised advance of 1.1% in the previous month, while market participants envisaged for a flat reading.

Macroeconomic data released in the US indicated that the ISM manufacturing activity index dropped more-than-expected to a level of 54.8 in April, expanding at its weakest pace in four months, thus adding to the narrative of a slowdown in the nation’s economic momentum. Markets were expecting the index to ease to a level of 56.5, compared to a level of 57.2 recorded in the previous month. Moreover, the nation’s construction spending unexpectedly eased 0.2% on a monthly basis in March, defying investor consensus for a gain of 0.4% and after recording a revised advance of 1.8% in the previous month. Also, the nation’s final Markit manufacturing PMI declined to a level of 52.8 in April, confirming the preliminary print and compared to a level of 53.3 in the previous month.

In other economic news, the nation’s personal spending remained flat for a second straight month in March, confounding market expectations for a rise of 0.2%. In the prior month, personal spending had registered a revised flat reading. On the contrary, the nation’s personal income gained 0.2% in March, falling short of market expectations for a rise of 0.3%. In the prior month, personal income had recorded a revised rise of 0.3%.

On Friday, the preliminary gross domestic product (GDP) data revealed that the US annualised GDP growth expanded 0.7% on a quarterly basis in the first quarter of 2017, growing at its weakest pace in 3 years, as consumers pulled back sharply on spending. The nation’s GDP grew 2.1% in the prior quarter, whereas market expected for an expansion of 1.0%. Moreover, the nation’s final Reuters/Michigan consumer sentiment index rose less-than-expected to a level of 97.0 in April, compared to a preliminary print of 98.0 and after registering a reading of 96.9 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0911, with the EUR trading slightly higher against the USD from yesterday’s close.

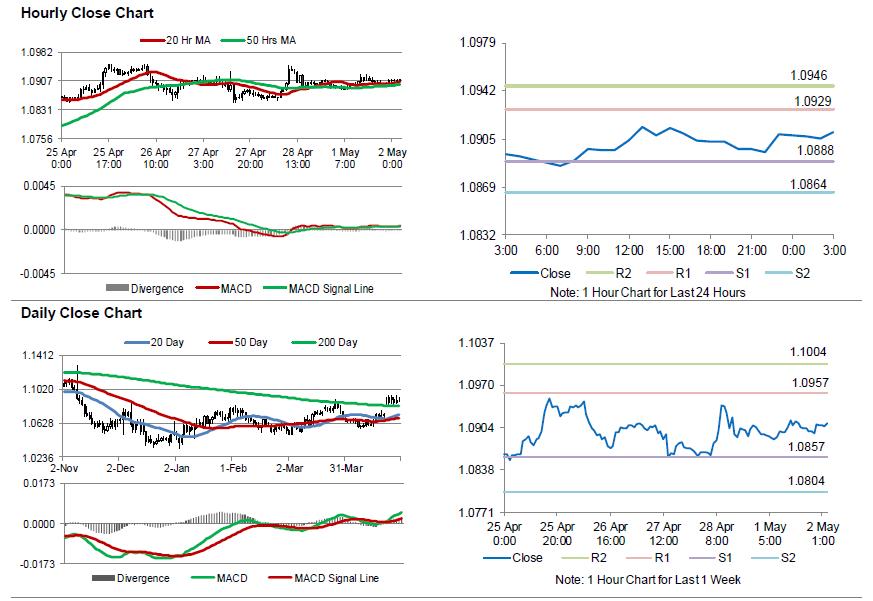

The pair is expected to find support at 1.0888, and a fall through could take it to the next support level of 1.0864. The pair is expected to find its first resistance at 1.0929, and a rise through could take it to the next resistance level of 1.0946.

Going ahead, investors will look forward to the final Markit manufacturing PMI for April across the Euro-zone along with the Euro-zone’s unemployment rate data for March, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.