For the 24 hours to 23:00 GMT, the EUR declined 0.73% against the USD and closed at 1.1370.

On the macro front, Germany’s producer price index (PPI) climbed 3.3% on an annual basis in October, in line with market expectations and notching its highest level since April 2017. In the prior month, the PPI had risen 3.2%.

The US dollar climbed against its major peers yesterday, following a rebound in the US housing starts in October.

In the US, data showed that the US housing starts jumped 1.5%, on a monthly basis, to an annual rate of 1228.0K in October, following a revised level of 1210.0K in the previous month. Housing starts fell 5.5% in the previous month. On the contrary, the nation’s building permits fell 0.6%, on a monthly basis, to an annual rate of 1263.0K in October. In the preceding month, building permits had registered a revised level of 1270.0K.

In the Asian session, at GMT0400, the pair is trading at 1.1373, with the EUR trading slightly higher against the USD from yesterday’s close.

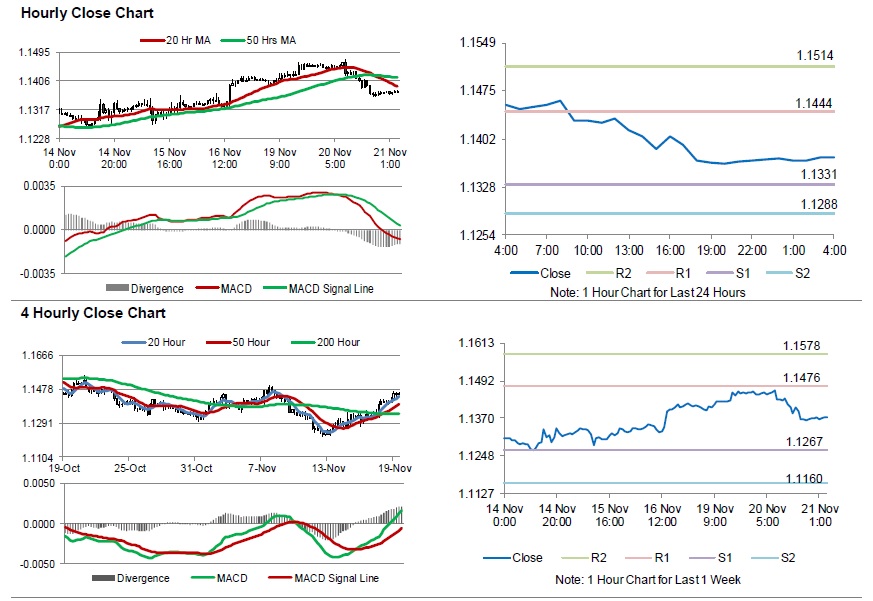

The pair is expected to find support at 1.1331, and a fall through could take it to the next support level of 1.1288. The pair is expected to find its first resistance at 1.1444, and a rise through could take it to the next resistance level of 1.1514.

Moving forward, traders would closely monitor the Euro-zone’s OECD economic outlook, set to release in a few hours. Later in the day, the US durable goods orders, leading index and existing home sales, all for October and the Michigan consumer sentiment index for November, will keep investors on their toes. Additionally, initial jobless claims and the MBA mortgage applications, will pique significant amount of investors’ attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.