For the 24 hours to 23:00 GMT, the EUR declined 0.1% against the USD and closed at 1.1790.

In economic news, the Euro-zone’s seasonally adjusted trade surplus widened more-than-expected to €21.6 billion in August, amid a rise in exports, thus easing fears about a strong Euro impacting trade. Meanwhile, markets had expected for a surplus of €20.2 billion. The region had reported a revised trade surplus of €17.9 billion in the prior month.

The greenback gained ground against its key peers, after the US President, Donald Trump, expressed confidence in his tax-reform plan and reiterated that it would be completed by the year-end. Moreover, reports that the US President would interview Janet Yellen for a potential second term as the Federal Reserve Chairwoman boosted investor sentiment.

Gains in the US Dollar were extended further, after data indicated that the US New York Empire State manufacturing index recorded an unexpected rise to a level of 30.2 in October, accelerating to a three-year high level and defying market consensus for a fall to a level of 20.4.

In the Asian session, at GMT0300, the pair is trading at 1.1784, with the EUR trading slightly lower against the USD from yesterday’s close.

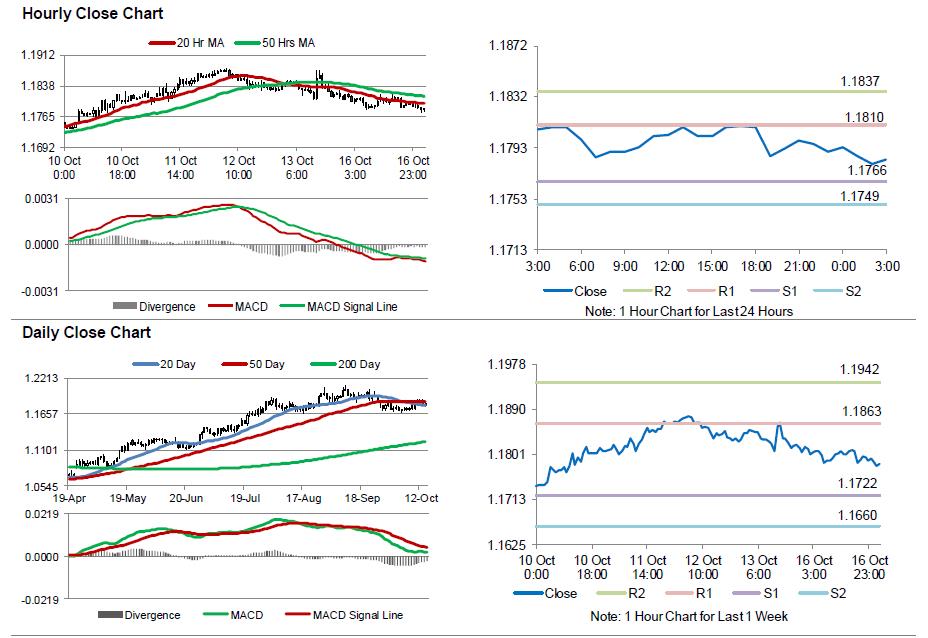

The pair is expected to find support at 1.1766, and a fall through could take it to the next support level of 1.1749. The pair is expected to find its first resistance at 1.1810, and a rise through could take it to the next resistance level of 1.1837.

Trading trend in the Euro today is expected to be determined by the ZEW economic sentiment survey for October slated to release across the Euro-zone in a few hours. Further, the US industrial and manufacturing production for September followed by the NAHB housing market index for October, all set to release later in the day, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.