For the 24 hours to 23:00 GMT, the EUR declined 0.33% against the USD and closed at 1.1294.

The US dollar gained ground against major currencies, after the US President Donald Trump is likely to raise tariffs on $200 billion to 25% from 10% on all the remaining Chinese imports. However, US President, Donald Trump, and Chinese President, Xi Jinping, would attempt to resolve the US-China trade war over a meeting this week.

In the US, data showed that the US CB consumer confidence index eased to a level of 135.7 in November, in line with market expectations. In the prior month, the index had recorded a reading of 137.9. On the other hand, the nation’s housing price index climbed 0.2% on a monthly basis in November, falling short of market expectations for a rise of 0.4%. In the previous month, the index had registered a revised gain of 0.4%.

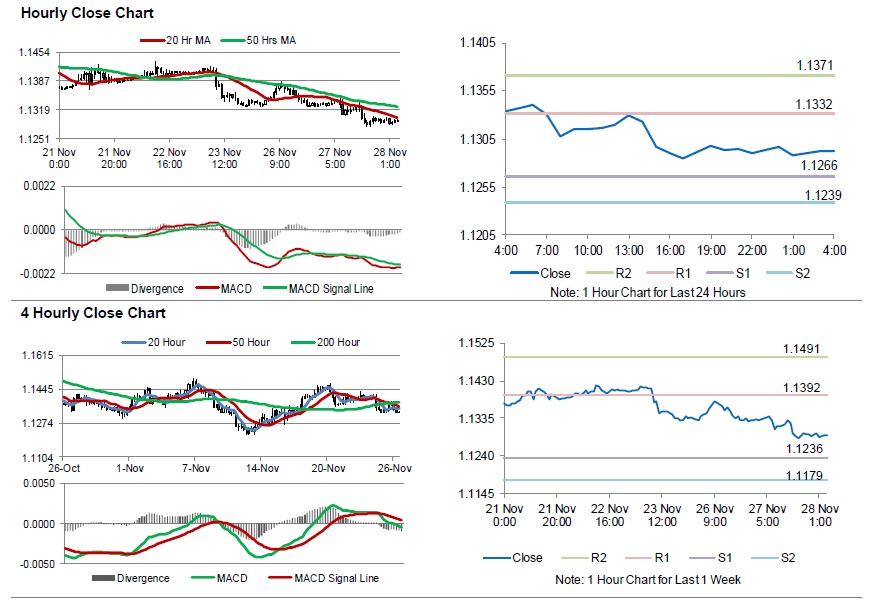

In the Asian session, at GMT0400, the pair is trading at 1.1293, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1266, and a fall through could take it to the next support level of 1.1239. The pair is expected to find its first resistance at 1.1332, and a rise through could take it to the next resistance level of 1.1371.

Looking forward, traders would closely monitor the Euro-zone’s M3 Money Supply for October followed by the German GfK consumer confidence for December, set to release in a few hours. Later in the day, the US 3Q annualised gross domestic product, advance goods trade balance, retail inventories and new home sales data along with the Richmond Fed manufacturing index for November and MBA mortgage applications, will garner significant market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.