For the 24 hours to 23:00 GMT, the EUR declined 0.47% against the USD and closed at 1.1665.

The US dollar gained ground against a basket of currencies, following Federal Reserve (Fed) Chairman, Jerome Powell, positive assessment on the US economy.

Fed Chairman, Jerome Powell, in his testimony, presented an upbeat assessment on the US economy. Further, he stated that economic growth in the second quarter was “considerably stronger” than in the first quarter and hence signalled a “gradual” pace of interest rate hikes. Additionally, he forecasted that the job market will remain strong and inflation will stay near 2% over the next several years.

In the US, data showed that US industrial production rebounded 0.6% on a monthly basis in June, higher than market consensus for a rise of 0.5%. In the prior month, industrial production had registered a revised drop of 0.5%. Additionally, manufacturing production climbed 0.8% on a monthly basis in June, while markets had expected for an advance of 0.7%. In the previous month, manufacturing production had recorded a revised fall of 1.0%. Meanwhile, the nation’s NAHB housing market index remained unchanged at 68.0 in July, in line with market expectations.

In the Asian session, at GMT0300, the pair is trading at 1.1654, with the EUR trading marginally lower against the USD from yesterday’s close.

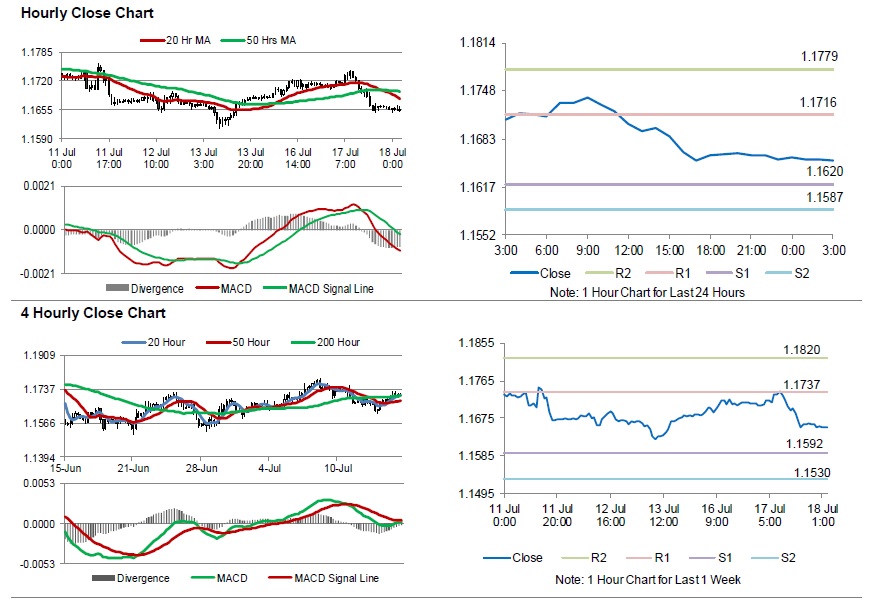

The pair is expected to find support at 1.1620, and a fall through could take it to the next support level of 1.1587. The pair is expected to find its first resistance at 1.1716, and a rise through could take it to the next resistance level of 1.1779.

Moving ahead, investors would closely monitor the Euro-zone’s final consumer price index for June, due to be released in a few hours. Also, the US mortgage applications followed by housing starts and building permits, both for June, scheduled to release later in the day, will garner significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.