On Friday, the EUR declined 0.06% against the USD and closed at 1.1188.

The preliminary consumer price index in Germany rebounded more than expected by 0.9% MoM in February, against market expectations of 0.6% rise and following a drop of 1.1% registered in the previous month, thus decreasing fears of deflation in the Euro-Zone’s biggest economy.

Elsewhere, the ECB’s Vice President Vitor Constancio stated that the economic and social benefits of the quantitative easing program will outweigh any possible financial risks.

The greenback traded on a stronger footing, after the US 4Q annualised GDP expanded more than expected at a rate of 2.2%, against an expected growth of 2.0% and following the preliminary rate 2.6% rise. Additionally, the nation’s Michigan confidence index climbed to 95.4 in February, compared to prior month’s reading of 93.6. Markets were expecting it to rise to a level of 94.0.

On the other hand, pending homes sales rose 6.5% YoY in January, lower than market expectations of an advance of 8.7%. It had risen by a revised 7.7% in the preceding month. Also, the Chicago PMI fell far more than expected to 45.8, registering its worst reading since July 2009 and compared to preceding month’s level of 59.4.

Separately, the New York Fed President William Dudley stated that if short-term interest rates continue to be low even after the Fed’s Open Market Committee starts lifting benchmark rates, then it would be appropriate to choose a more aggressive monetary policy stance.

In the Asian session, at GMT0400, the pair is trading at 1.1177, with the EUR trading 0.1% lower from Friday’s close.

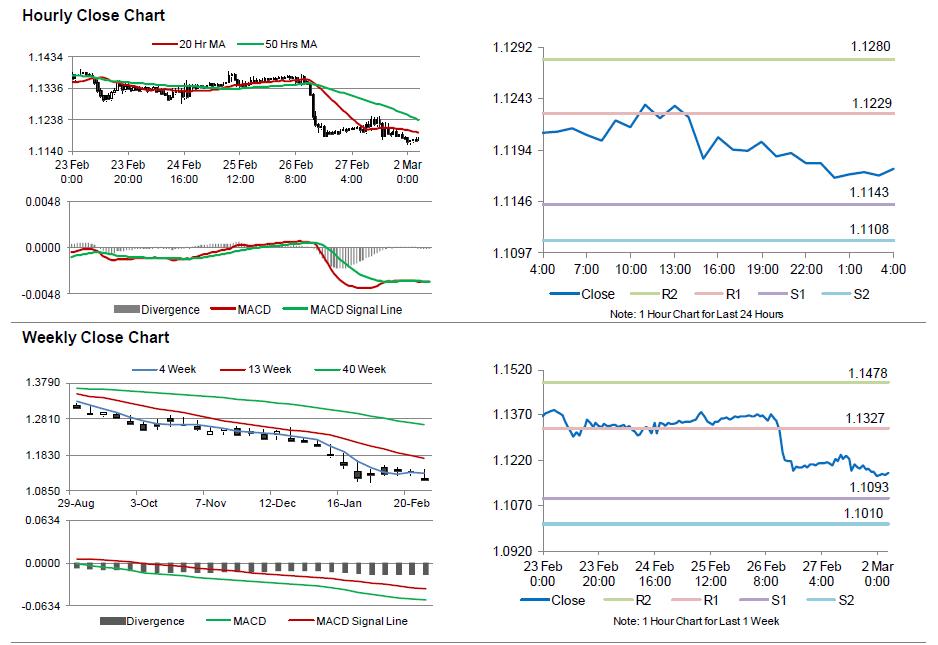

The pair is expected to find support at 1.1143, and a fall through could take it to the next support level of 1.1108. The pair is expected to find its first resistance at 1.1229, and a rise through could take it to the next resistance level of 1.1280.

Trading trends in the Euro today are expected to be determined by the Markit manufacturing PMI data from the Euro-zone and its peripheries, scheduled in a few hours. Meanwhile, investors would keep a close eye on the US ISM manufacturing PMI data, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.