For the 24 hours to 23:00 GMT, the EUR rose 0.3% against the USD and closed at 1.1316.

Yesterday, the Federal Reserve Chair, Janet Yellen, expressed concerns about tumbling financial markets and highlighted that falling oil prices have adversely affected the US inflation. She also stated that, the Fed is prepared to cut short-term interest rates into negative territory if the economy takes a downturn and the central bank is evaluating its possible effects on the US economy.

In other economic news, the US initial jobless claims declined to a seven-week low level of 269.0K in the week ended 06 February, higher than market expectations of a fall to a level of 280.0K, suggesting the labour market remains strong despite slowing economic growth. In the previous week initial jobless claims recorded a reading of 285.0K.

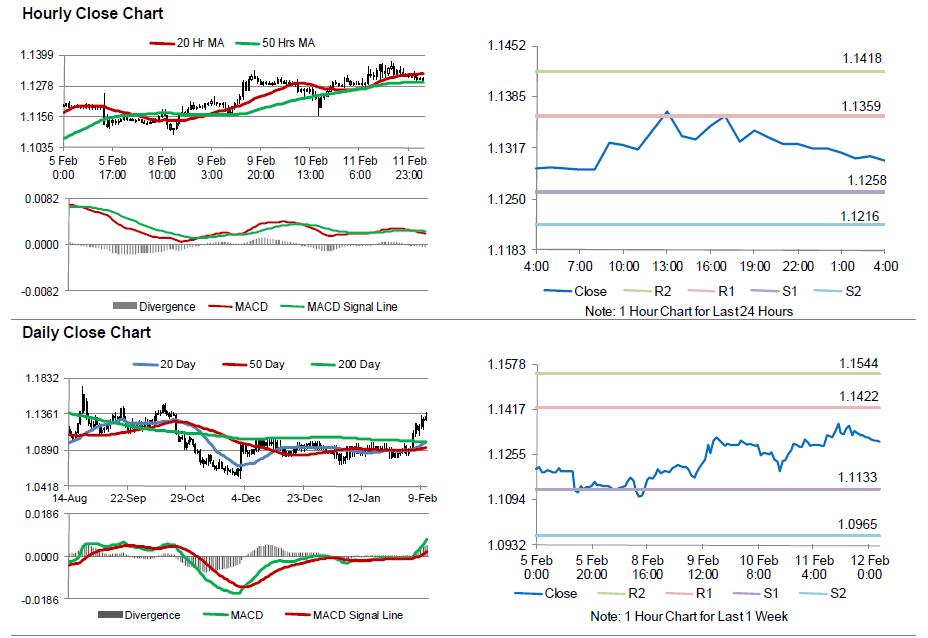

In the Asian session, at GMT0400, the pair is trading at 1.1301, with the EUR trading 0.14% lower from yesterday’s close.

The pair is expected to find support at 1.1258, and a fall through could take it to the next support level of 1.1216. The pair is expected to find its first resistance at 1.1359, and a rise through could take it to the next resistance level of 1.1418.

Going ahead, market participants will look forward to Germany’s consumer price index data and Q4 flash GDP data across the Eurozone, slated to be released in a few hours. Additionally, the US advance retail sales and preliminary Reuters/Michigan consumer sentiment index data, set for release later today, will also attract a lot of market attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.