For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.1190.

Yesterday, data showed that Eurozone’s final manufacturing PMI for September stayed unchanged from its earlier estimate at 52.0, on the back of a slower pace in output and new orders. Meanwhile, Germany’s final manufacturing PMI for the last month fell slightly to 52.3, from 52.5 in August, whereas Italy’s figure came in below expectations at 52.7 for the same month. However, the final manufacturing PMI in France rose to 50.6, exceeding market expectations for the reading to remain unchanged at 50.4.

In the US, initial jobless claims rose to a seasonally adjusted 277,000 for the week ended 26 September, however still depicting a strengthening US labor market. Meanwhile, continuing jobless claims dropped to 2.19 million in the week ended 19 September, the fewest since November 2000.

In other economic news, the US markit manufacturing PMI for September edged up to 53.1, while the ISM manufacturing PMI for September was slightly down, coming in at 50.2. Additionally, the ISM prices paid registered a below-expectation reading of 38.0 in the same month. Construction spending in the US exceeded expectations and climbed 0.7% MoM in August, its highest level since 2008, fuelled by government projects and home building.

Separately, the San Francisco Fed President, John Williams, stated that the central bank is likely to raise interest rates as early as October this year, as the US economy is nearing full employment

In the Asian session, at GMT0300, the pair is trading at 1.1188, with the EUR trading marginally lower from yesterday’s close.

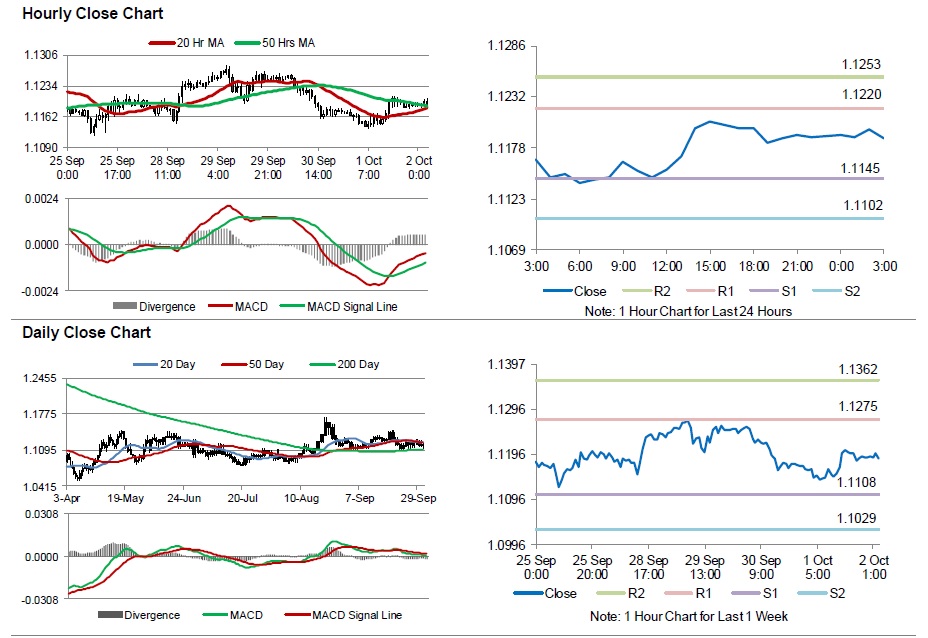

The pair is expected to find support at 1.1145, and a fall through could take it to the next support level of 1.1102. The pair is expected to find its first resistance at 1.1220, and a rise through could take it to the next resistance level of 1.1253.

Going ahead, the US non-farm payrolls, unemployment rate as factory orders data, scheduled later today, would also grab lot of market attention.

The currency pair is trading above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.