For the 24 hours to 23:00 GMT, the EUR rose 0.18% against the USD and closed at 1.2258, following encouraging political developments in Germany, as the Social Democrats (SPD) voted in favour of pursuing coalition talks with Angela Merkel’s conservatives.

The greenback declined against a basket of major currencies, as news of the US Senators voting to lift a three-day government shutdown failed to boost investor sentiment.

In the US, data indicated that the Chicago Fed national activity index rose to a level of 0.27 in December, compared to a revised reading of 0.11 in the previous month, while market participants had anticipated for an increase to a level of 0.22.

Separately, the International Monetary Fund (IMF), in an update of its World Economic Outlook, boosted its global economic growth forecast to 3.9% for both 2018 and 2019, up by 0.2% from its previous estimate. Additionally, the Fund revised up its economic outlook for the Euro-bloc to 2.2% in 2018, up 0.3% from its earlier projection in October.

However, the organisation also forecasted that economic growth in the US would likely slowdown after 2022, as the tax cuts would give the American economy a short-term boost. The Fund now expects the world’s largest economy to expand by 2.7% in 2018, sharply higher than its previous prediction of 2.3%. Growth was projected to slow to 2.5% in 2019.

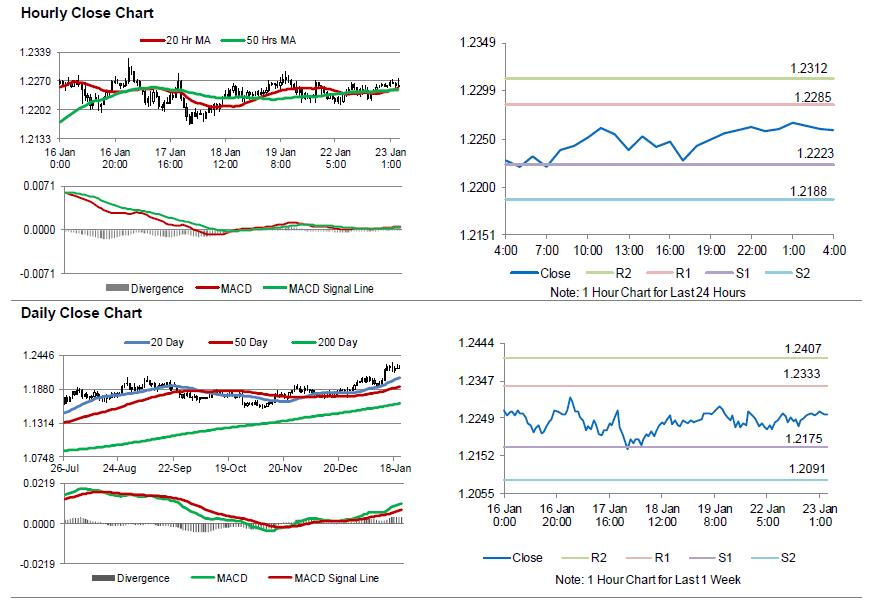

In the Asian session, at GMT0400, the pair is trading at 1.2259, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2223, and a fall through could take it to the next support level of 1.2188. The pair is expected to find its first resistance at 1.2285, and a rise through could take it to the next resistance level of 1.2312.

Going ahead, market participants would look forward to the release of the ZEW economic sentiment index for January across the Eurozone, scheduled in a few hours. Also, the region’s flash consumer confidence index for January, slated to release later in the day, would be eyed by traders. Additionally, the US Richmond Fed manufacturing index for January, would be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.