For the 24 hours to 23:00 GMT, the EUR rose 0.44% against the USD and closed at 1.1770, following bullish comments from European Central Bank’s Chief Economist, Peter Praet.

The ECB Chief Economist stated that the underlying strength in the economy will persist and inflation expectations were increasingly in line with the bank’s target. Further, he signalled the end of ECB’s money-printing programme in September.

Macroeconomic data released in the US indicated, that trade deficit unexpectedly narrowed to a seven-month low level of $46.2 billion in April, driven by an increase in the value of exports. The nation had registered a revised deficit of $47.2 billion in the prior month, while markets were expecting the nation to post a deficit of $49.0 billion. Meanwhile, the nation’s MBA mortgage applications rose 4.1% in the week ended 01 June, compared to a drop of 2.9% in the previous week.

In the Asian session, at GMT0300, the pair is trading at 1.1790, with the EUR trading 0.17% higher against the USD from yesterday’s close.

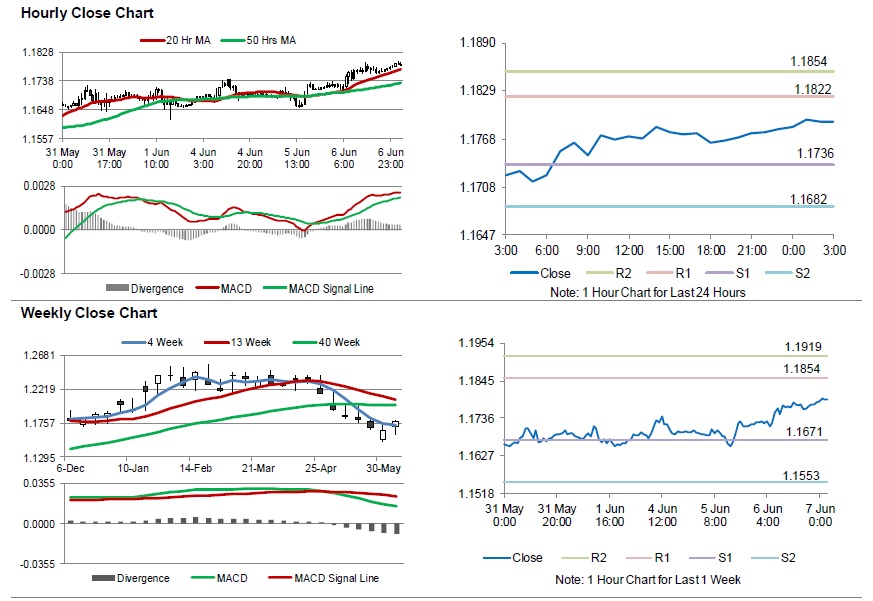

The pair is expected to find support at 1.1736, and a fall through could take it to the next support level of 1.1682. The pair is expected to find its first resistance at 1.1822, and a rise through could take it to the next resistance level of 1.1854.

Moving ahead, investors would closely monitor Euro-zone’s final 1Q GDP figures scheduled to release in a few hours. Additionally, Germany’s factory orders data for April, will be eyed by traders. Later in the day, the US initial jobless claims and consumer credit data for April, would pique significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.