For the 24 hours to 23:00 GMT, the EUR declined 0.75% against the USD and closed at 1.1541, as deepening political instability in Italy continued to dent investor sentiment.

In economic news, French consumer confidence index surprisingly remained steady at a level of 100.0 in May, defying market consensus for a rise to a level of 101.0.

Meanwhile, Italy’s consumer confidence index declined more-than-expected to a level of 113.7 in May, hitting its lowest level in 9 months and compared to market expectations for a fall to a level of 116.5. The index had registered a revised reading of 116.9 in the previous month.

Macroeconomic data released in the US showed that the CB consumer confidence index climbed to a 3-month high level of 128.0 in May, meeting market expectations and suggesting that robust labour market and improving business conditions continue to lighten Americans’ economic outlook. The index had registered a revised level of 125.6 in the prior month.

In other economic news, the nation’s Dallas Fed manufacturing business index advanced to a level of 26.8 in May, beating market expectations for a rise to a level of 23.0. The index had registered a level of 21.8 in the previous month.

Separately, the St. Louis Federal Reserve (Fed) President, James Bullard, stated that the central bank should be cautious in raising interest rates further unless economic data surprises to the upside, as inflation expectations remain somewhat low.

In the Asian session, at GMT0300, the pair is trading at 1.1524, with the EUR trading 0.15% lower against the USD from yesterday’s close.

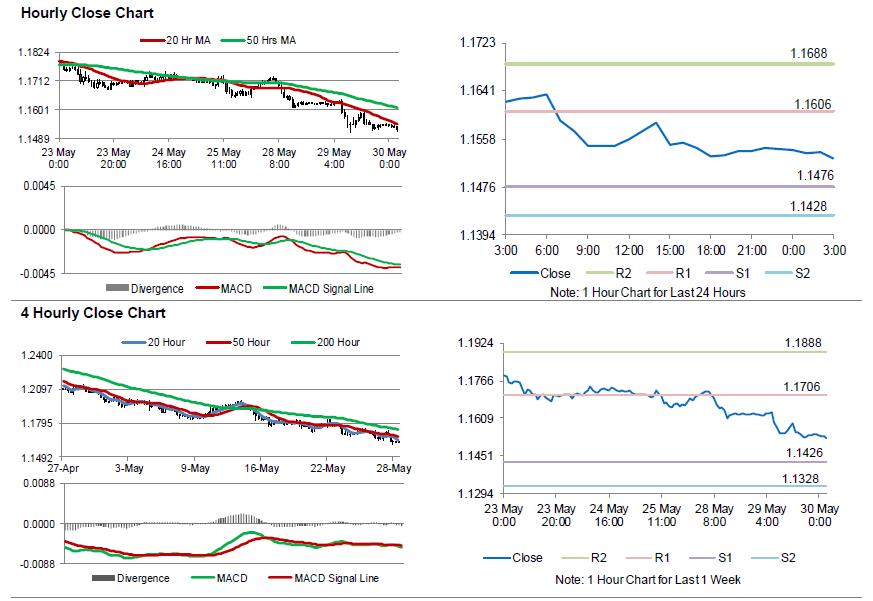

The pair is expected to find support at 1.1476, and a fall through could take it to the next support level of 1.1428. The pair is expected to find its first resistance at 1.1606, and a rise through could take it to the next resistance level of 1.1688.

Trading trend in the Euro today is expected to be determined by the release of Germany’s flash inflation figures and unemployment rate data, both for May, slated to release in a few hours. Later in the day, investors would look forward to the release of US 1Q GDP numbers, ADP employment change for May, advance goods trade balance for April as well as the Fed’s Beige Book report.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.