For the 24 hours to 23:00 GMT, the EUR rose 0.3% against the USD and closed at 1.1816 on Friday.

In economic news, the Euro-zone’s flash consumer price index (CPI) climbed less-than-anticipated by 1.5% on an annual basis in September, indicating that economic expansion across the common currency region has yet to translate in stronger inflation dynamics. The CPI had registered a similar rise in the prior month, while market participants had expected for an advance of 1.6%.

Separately, Germany’s seasonally adjusted unemployment rate unexpectedly declined to a new record low of 5.6% in September, painting a robust picture of the nation’s labour market. Markets had expected the unemployment to remain steady at 5.7%. On the other hand, the nation’s retail sales registered an unexpected drop of 0.4% MoM in August, defying market consensus for a gain of 0.5%. In the previous month, retail sales had fallen 1.2%.

Macroeconomic data released in the US indicated that personal income rose 0.2% in August, meeting market expectations and compared to a revised advance of 0.3% in the previous month. Moreover, the nation’s personal spending registered a rise of 0.1% in August, in line with market expectations. In the prior month, personal spending had advanced 0.3%. Moreover, the nation’s Chicago Fed purchasing managers index unexpectedly rose to a three-year high level of 65.2 in September, confounding market consensus for a drop to a level of 58.7. The index had registered a reading of 58.9 in the prior month.

In other economic news, the US final Reuters/Michigan consumer sentiment index fell more than initially estimated to a level of 95.1 in September, compared to a preliminary print indicating a fall to a level of 95.3. In the previous month, the index had registered a reading of 96.8.

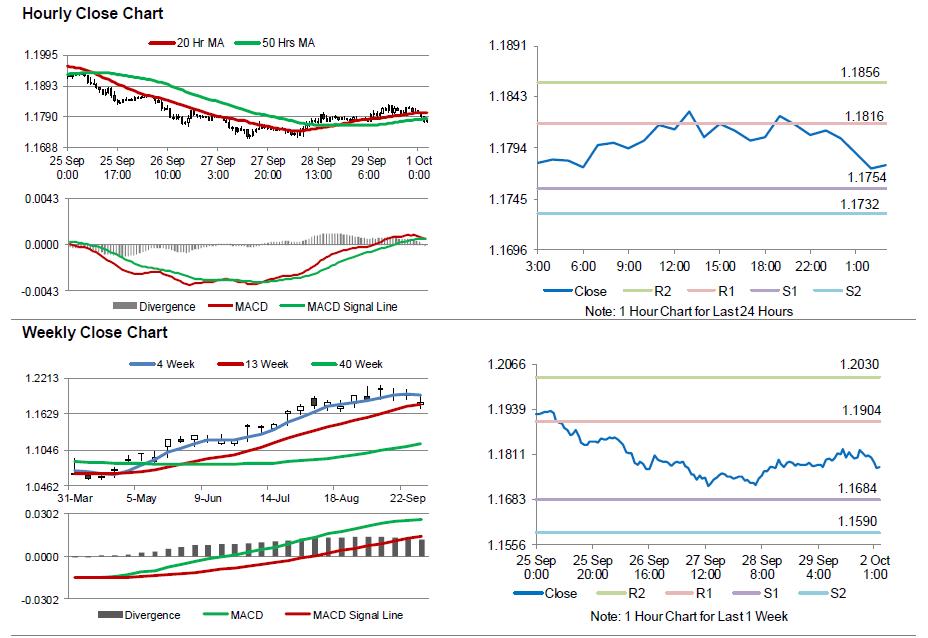

In the Asian session, at GMT0300, the pair is trading at 1.1777, with the EUR trading 0.33% lower against the USD from Friday’s close.

The pair is expected to find support at 1.1754, and a fall through could take it to the next support level of 1.1732. The pair is expected to find its first resistance at 1.1816, and a rise through could take it to the next resistance level of 1.1856.

Moving ahead, investors will focus on the final Markit manufacturing PMI for September across the Euro-zone along with the region’s unemployment rate for August, slated to release in a few hours. Moreover, in the US, the ISM manufacturing and the final Markit manufacturing PMI, both for September along with the nation’s construction spending data for August, all set to release later today, will garner significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.