For the 24 hours to 23:00 GMT, the EUR rose 0.19% against the USD and closed at 1.1483.

On the macro front, the Euro-zone’s final consumer price index (CPI) advanced 1.3% on an annual basis in June, confirming the preliminary print indicating the slowest increase in six months. The CPI had registered a gain of 1.4% in the prior month.

In the US, data showed that the New York Empire State manufacturing index fell more-than-expected to a level of 9.8 in July, after recording a two-year high level of 19.8 in the prior month, while market participants were expecting a drop to a level of 15.0.

In the Asian session, at GMT0300, the pair is trading at 1.1530, with the EUR trading 0.41% higher against the USD from yesterday’s close, after two more Republican senators expressed their disagreement to repeal and replace Obamacare with Republican health-care bill, raising fresh questions about the US President, Donald Trump’s ability to fulfil his policies.

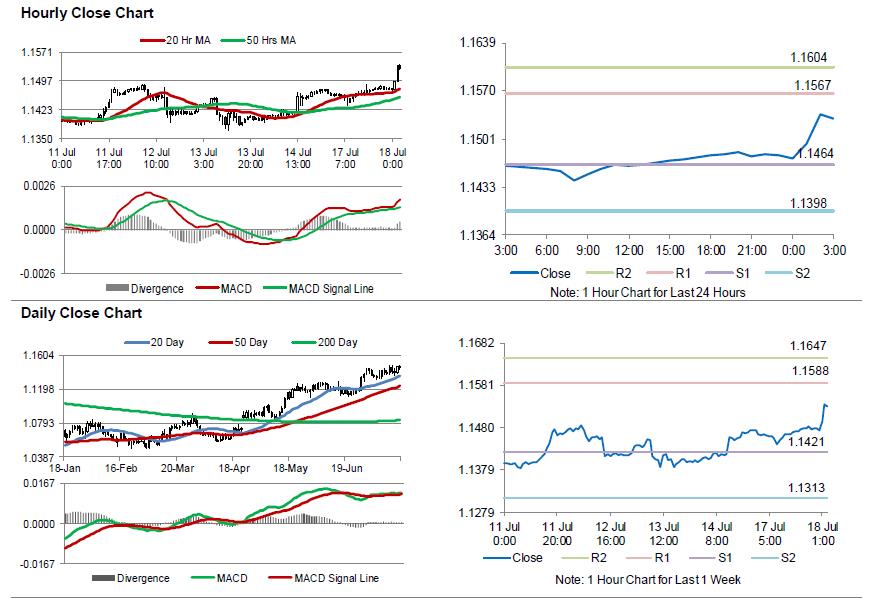

The pair is expected to find support at 1.1464, and a fall through could take it to the next support level of 1.1398. The pair is expected to find its first resistance at 1.1567, and a rise through could take it to the next resistance level of 1.1604.

Moving ahead, investors will focus on the release of ZEW survey of economic sentiment for July across the Euro-zone, slated to release in a few hours. Moreover, the US NAHB housing market index for July, set to be released later in the day, will also grab market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.