For the 24 hours to 23:00 GMT, the EUR declined 0.33% against the USD and closed at 1.2494 on Friday.

On the economic front, the Euro-zone’s producer price index (PPI) climbed 2.2% on an annual basis in December, rising at its slowest pace in 5 months. The PPI had advanced 2.8% in the previous month, while markets were expecting for a gain of 2.3%.

The US Dollar gained ground against a basket of major currencies on Friday, propelled by better-than-expected US jobs report.

Data showed that non-farm payrolls in the US increased more-than-estimated by 200.0K in January, compared to market anticipations for an advance of 180.0K. Non-farm payrolls had recorded a revised gain of 160.0K in the prior month. Further, the nation’s average hourly earnings of all employees grew 0.3% on a monthly basis in January, beating market expectations for a rise of 0.2%, thus boosting hopes that inflation will push higher as tighter labour market is finally fuelling wage growth. In the previous month, average hourly earnings of all employees had recorded a revised rise of 0.4%. Moreover, the nation’s unemployment rate remained unchanged at a 17-year low rate of 4.1% in January, meeting market expectations.

Other data revealed that the US final Reuters/Michigan consumer sentiment index registered a drop to a level of 95.7 in January, less than a flash print indicating a fall to a level of 94.4. The index had registered a level of 95.9 in the prior month. On the contrary, the nation’s factory orders climbed more-than-expected by 1.7% on a monthly basis in December, after recording a revised similar rise in the prior month and compared to market expectations for a rise of 1.5%. Meanwhile, the nation’s final durable goods orders rose less than initially estimated by 2.8% in December, while the preliminary figures had indicated a gain of 2.9%. Durable goods orders had registered a revised increase of 1.7% in the previous month.

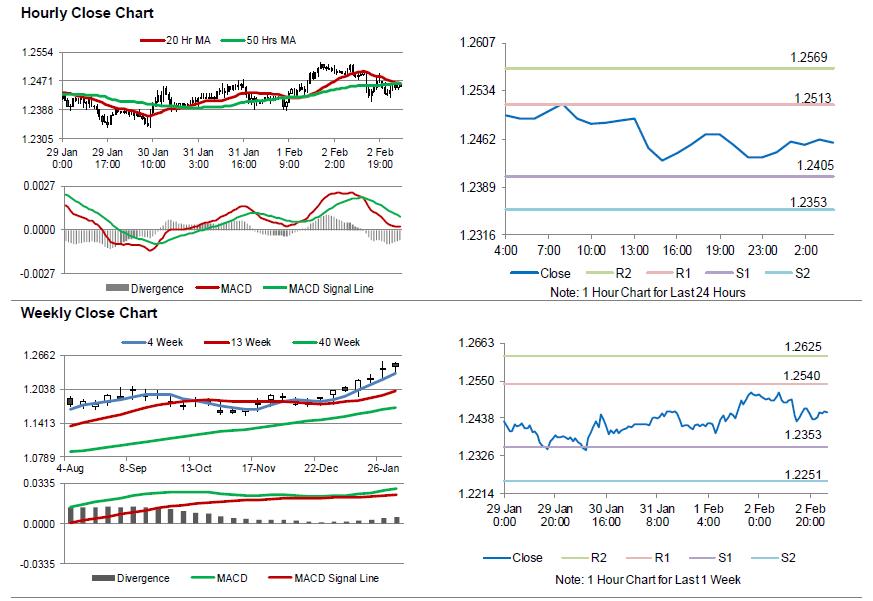

In the Asian session, at GMT0400, the pair is trading at 1.2456, with the EUR trading slightly higher against the USD from Friday’s close.

The pair is expected to find support at 1.2405, and a fall through could take it to the next support level of 1.2353. The pair is expected to find its first resistance at 1.2513, and a rise through could take it to the next resistance level of 1.2569.

Moving ahead, investors would keep a close watch on the final Markit services PMIs for January, scheduled to release across the Euro-zone in a few hours. Additionally, the Euro-zone’s Sentix investor confidence index for February as well as retail sales for December, will also be eyed by traders. Later in the day, the US ISM non-manufacturing and the final Markit manufacturing PMIs for January, will attract a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.