For the 24 hours to 23:00 GMT, the EUR declined 0.43% against the USD and closed at 1.1150.

On the macro front, the Euro-zone’s seasonally adjusted construction output rebounded 0.3% on a monthly basis in April, following a drop of 1.1% in the previous month.

The US Dollar advanced against its key peers, after a key Federal Reserve (Fed) policymaker indicated that a third interest rate hike this year remains on the table.

The New York Federal Reserve (Fed) President, William Dudley, offered an upbeat assessment of the US economy, stating that tightening in the labour market will push wages higher and will eventually help drive up inflation. However, the Chicago Fed President, Charles Evans, noted that the Fed should move slowly to raise rates and shrink its portfolio, as inflation is stubbornly soft.

In the Asian session, at GMT0300, the pair is trading at 1.1156, with the EUR trading slightly higher against the USD from yesterday’s close.

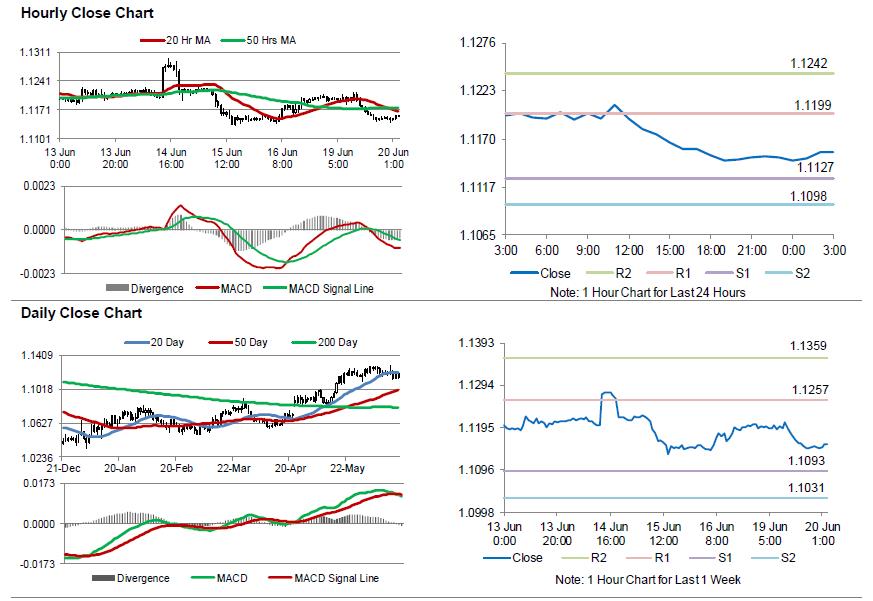

The pair is expected to find support at 1.1127, and a fall through could take it to the next support level of 1.1098. The pair is expected to find its first resistance at 1.1199, and a rise through could take it to the next resistance level of 1.1242.

Moving ahead, investors will look forward to the Euro-zone’s current account data for April, slated to release in a few hours. Additionally, market participants would eye comments from a few Fed officials as they are scheduled to speak later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.