For the 24 hours to 23:00 GMT, the EUR declined 0.4% against the USD and closed at 1.2335, after the Euro-zone’s preliminary consumer confidence index slid more-than-anticipated to a level of 0.1 in February, dropping for the first time in seven months. The index had registered a level of 1.3 in the previous month, while investors had envisaged for a fall to a level of 1.0.

Additionally, the region’s ZEW economic sentiment index dropped less-than-anticipated to a level of 29.3 in February, compared to a reading of 31.8 in the prior month, while markets were expecting for a fall to a level of 28.4.

Separately, economic sentiment in Germany deteriorated to a level of 17.8 in February, as continuous political uncertainty in the nation and turmoil in global equities dented investor confidence. Market participants had anticipated the index to fall to a level of 16.0, after registering a level of 20.4 in the previous month. Meanwhile, the nation’s ZEW current situation index declined more-than-expected to a level of 92.3 in February, compared to market expectations for a drop to a level of 93.9. In the prior month, the index had registered a record high level of 95.2.

Other data showed that Germany’s producer price index (PPI) rose 2.1% on an annual basis in January, higher than market expectations for a rise of 1.8%. However, this was the weakest growth since December 2016. In the previous month, the PPI had risen 2.3%.

In the Asian session, at GMT0400, the pair is trading at 1.2331, with the EUR trading slightly lower against the USD from yesterday’s close.

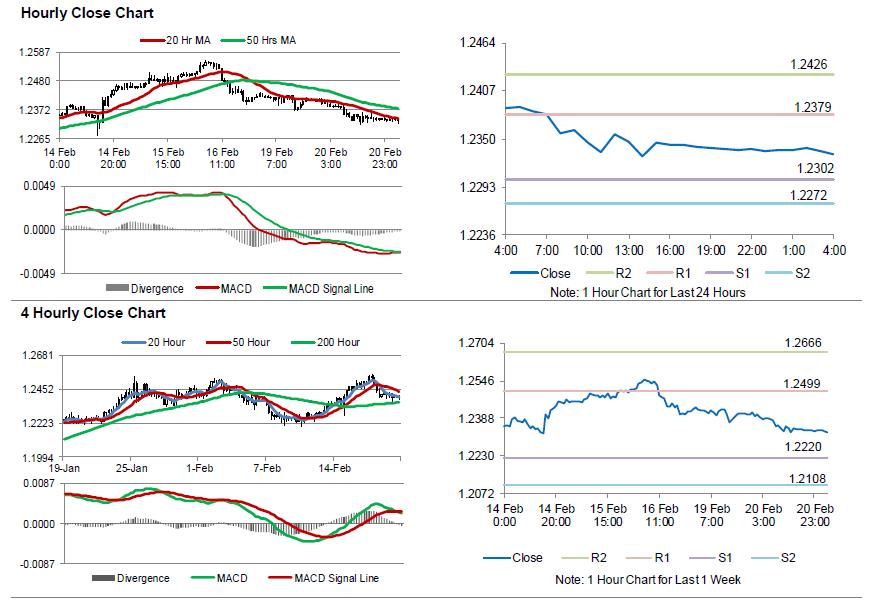

The pair is expected to find support at 1.2302, and a fall through could take it to the next support level of 1.2272. The pair is expected to find its first resistance at 1.2379, and a rise through could take it to the next resistance level of 1.2426.

Trading trend in the Euro today is expected to be determined by the Markit manufacturing and services PMIs for February, slated to release across the Euro-zone in a few hours. Moreover, the US flash Markit manufacturing and services PMIs for February coupled with the nation’s existing home sales data for January, all set to release later in the day, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.