For the 24 hours to 23:00 GMT, the EUR declined 0.1% against the USD and closed at 1.2232 on Friday.

In economic news, the Euro-zone’s seasonally adjusted current account surplus widened to €32.5 billion in November, after dropping for two straight months and compared to a revised surplus of €30.3 billion in the previous month.

Separately, Germany’s producer price index (PPI) rose 2.3% on an annual basis in December, at par with market expectations. In the prior month, the PPI had climbed 2.5%.

The greenback advanced against most of its major counterparts on Friday, as investors shrugged off worries over a possible US government shutdown.

Macroeconomic data released in the US indicated that the flash Reuters/Michigan consumer sentiment index unexpectedly dropped to a level of 94.4 in January, dipping to its lowest level since July 2017, as consumers turned less optimistic about the current economic conditions. The index had registered a level of 95.9 in the previous month, while markets had expected for a rise to a level of 97.0.

In the Asian session, at GMT0400, the pair is trading at 1.2228, with the EUR trading a tad lower against the USD from Friday’s close.

Meanwhile, the US government could not avert a shutdown, after members of the Senate failed to reach an agreement to fund government operations before the Friday’s deadline.

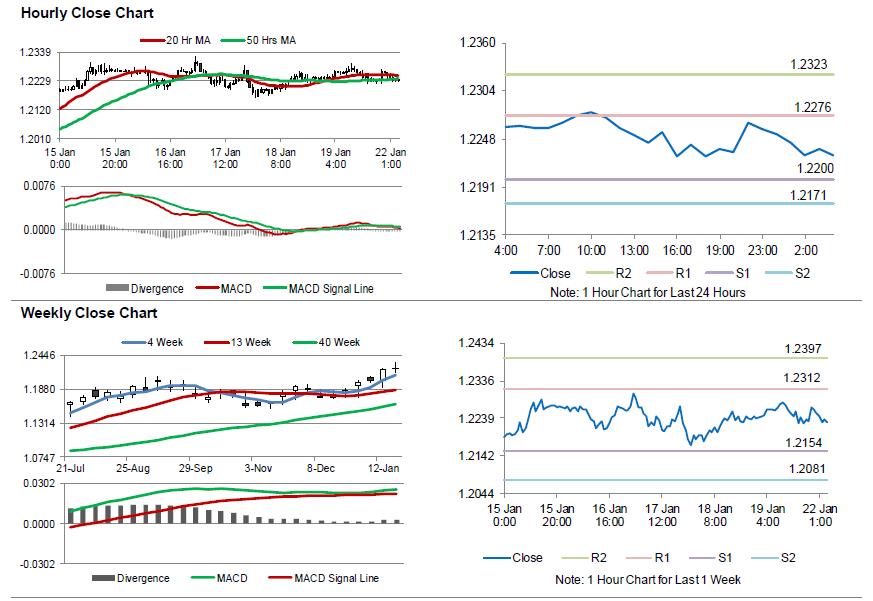

The pair is expected to find support at 1.2200, and a fall through could take it to the next support level of 1.2171. The pair is expected to find its first resistance at 1.2276, and a rise through could take it to the next resistance level of 1.2323.

Amid a lack of macroeconomic releases in the Euro-zone today, investors would focus on the US Chicago Fed national activity index for December, scheduled to release later in the day.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.