For the 24 hours to 23:00 GMT, the EUR rose 0.24% against the USD and closed at 1.1339.

On the macro front, the Euro-zone’s seasonally adjusted current account surplus narrowed to €16.2 billion in December, amid decline in exports and following a revised surplus of €22.6 billion in the prior month. Moreover, the region’s ZEW economic sentiment index climbed to a level of -16.6 in February, compared to a reading of -20.9 in the previous month. Meanwhile, the nation’s seasonally adjusted construction output slid 0.4% on a monthly basis in December, compared to a revised gain of 0.3%.

Separately, in Germany, the ZEW current situation index eased to a level of 15.0 in February, more than market consensus for a fall to a level of 20.0. The index had registered a level of 27.6 in the previous month. Furthermore, the nation’s ZEW economic sentiment index rose to a level of -13.4 in February, following a level of -15.0 in the preceding month. Market participants had envisaged the index to record a reading of -14.0.

The US dollar fell against a basket of currencies yesterday, amid hopes for a trade deal between the US and China.

In the US, data showed that the US NAHB housing market index advanced to a four-month high level of 62.0 in February, surpassing market anticipations for a rise to a level of 59.0 and compared to level of 58.0 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1345, with the EUR trading 0.05% higher against the USD from yesterday’s close.

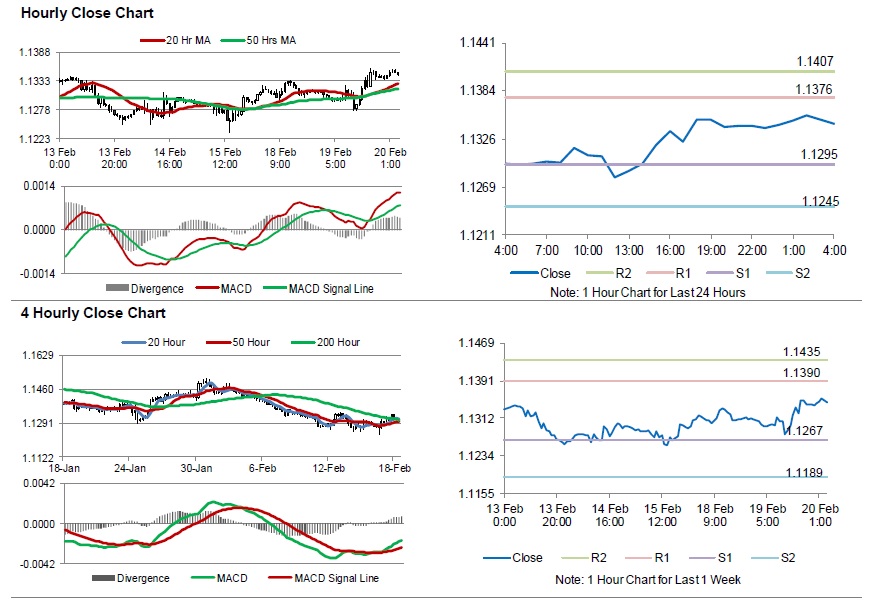

The pair is expected to find support at 1.1295, and a fall through could take it to the next support level of 1.1245. The pair is expected to find its first resistance at 1.1376, and a rise through could take it to the next resistance level of 1.1407.

Looking ahead, traders would await Euro-zone’s consumer confidence index for February and Germany’s producer price index for January, set to release in a few hours. Later in the day, the US FOMC meeting minutes along with the MBA mortgage applications would pique significant amount of investors’ attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.