For the 24 hours to 23:00 GMT, the EUR declined 0.66% against the USD and closed at 1.0529 on Friday, after the Euro-zone’s seasonally adjusted retail sales fell 0.4% MoM in November, at par with market expectations and following a revised gain of 1.4% in the prior month.

On the contrary, the region’s final consumer confidence index improved to a level of -5.1 in December, driven by increased optimism over the region’s economic outlook. The preliminary figures had also indicated an advance to a level of -5.1, while the index recorded a revised level of -6.2 in the prior month. Moreover, the region’s economic sentiment indicator climbed more-than-expected to a level of 107.8 in December, jumping to its highest level since March 2011 and compared to a revised level of 106.6 in the previous month. Further, the business climate indicator increased better-than-anticipated to a level of 0.79 in December, notching its strongest level since July 2011. In the previous month, the index had registered a revised level of 0.41.

Separately, Germany’s retail sales dropped 1.8% on a monthly basis in November, declining for the first time since March 2016 and after recording a revised gain of 2.5% in the previous month. Meanwhile, markets had envisaged retail sales to ease 0.9%. Also, the nation’s seasonally adjusted factory orders fell 2.5% in November, following a revised rise of 5.0% in the prior month.

On Friday, the greenback gained ground against its key counterparts, after robust wage growth in the US in December increased prospects of a Federal Reserve (Fed) interest rate hike in the first quarter of 2017.

Data revealed that the US average hourly earnings of all employees climbed 2.9% on an annual basis in December, posting its biggest rise since 2009. Markets expected average hourly earnings to advance 2.8%, following a rise of 2.5% in the prior month. However, the nation’s non-farm payrolls came in weaker-than-forecasted, rising by 156.0K in December, pointing to a slowdown in hiring. Non-farm payrolls had registered a revised increase of 204.0K in the prior month, while investors had expected for an increase of 175.0K. Additionally, the nation’s unemployment rate inched higher to 4.7% in December, meeting market consensus and compared to a level of 4.6% in the previous month. Moreover, factory orders eased more-than-anticipated by 2.4% in November, declining for the first time in five months. In the previous month, factory orders had recorded a revised rise of 2.8%. Meanwhile, the nation’s final durable goods orders dropped 4.5% in November, revised up from 4.6%, recorded in the preliminary figures and following a revised gain of 4.8% in the previous month. Also, the nation posted a less-than-expected trade deficit of $45.2 billion in November, hitting its highest level in nine-months and compared to a revised deficit of $42.4 billion in the previous month.

Separately, the Chicago Fed President, Charles Evans stated he has two interest rate hikes pencilled in for 2017, but added that a forecast of three hikes is “not implausible”. Meanwhile, the Dallas Fed President, Robert Kaplan supported a gradual and patient path for interest rate hikes in 2017, arguing that it was too early to know whether Trump’s administration policies would boost economic growth. Further, he indicated that he was not ready to “pre-judge” changes in tax and spending policies in the incoming administration.

In the Asian session, at GMT0400, the pair is trading at 1.0529, with the EUR trading flat against the USD from Friday’s close.

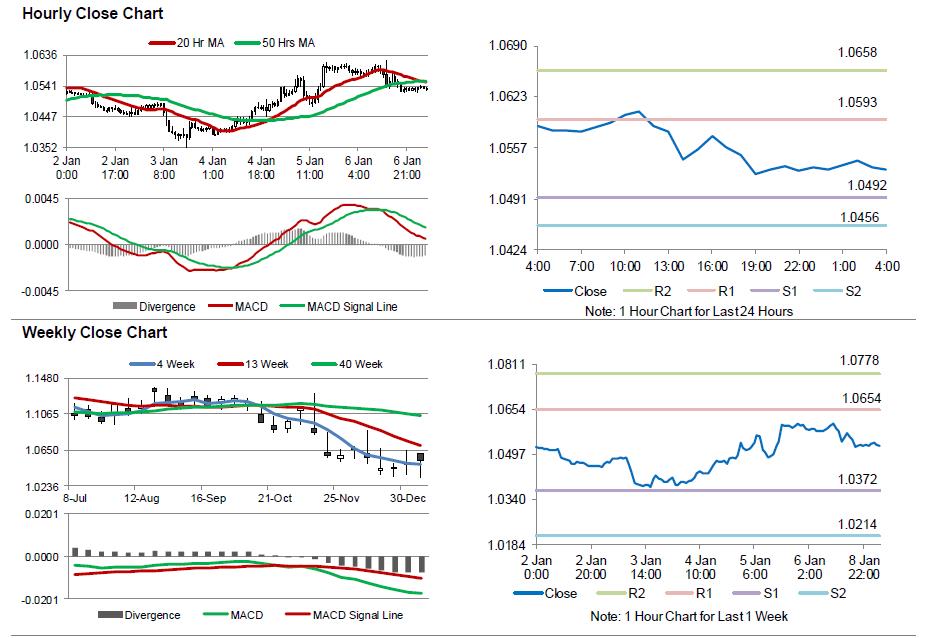

The pair is expected to find support at 1.0492, and a fall through could take it to the next support level of 1.0456. The pair is expected to find its first resistance at 1.0593, and a rise through could take it to the next resistance level of 1.0658.

Going ahead, investors will look forward to the Euro-zone’s unemployment rate for November and Sentix investor confidence index for January, following Germany’s trade balance and industrial production figures, both for November, slated to release in a few hours. Moreover, the US consumer credit change for November and labour market conditions index for December, both scheduled to release later in the day, will be keenly watched by traders.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.