For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.1798.

Data indicated that the Euro-zone’s seasonally adjusted final gross domestic product (GDP) rose 0.4% on a quarterly basis in the first three months of 2018, in line with market expectations. The preliminary figures had also indicated a rise of 0.4%. In the prior quarter, GDP had expanded 0.6%.

Meanwhile, in Germany, the seasonally adjusted factory orders unexpectedly fell 2.5% on a monthly basis in April, due to a decline in domestic orders and defying market expectations for a rise of 0.8%. Factory orders had dropped by a revised 1.1% in the previous month.

In the US, data revealed that that the number of Americans filing for fresh unemployment benefits dropped slightly to a level of 222.0K in the week ended 02 June, hitting a 4-week low level and compared to market expectations for a drop to a level of 220.0K. Initial jobless claims had registered a revised level of 223.0K in the prior week.

Other data showed that, the nation’s consumer credit climbed $9.3 billion in April, less than market forecast for a rise of $14.0 billion. In the prior month, consumer credit had climbed by a revised $12.3 billion.

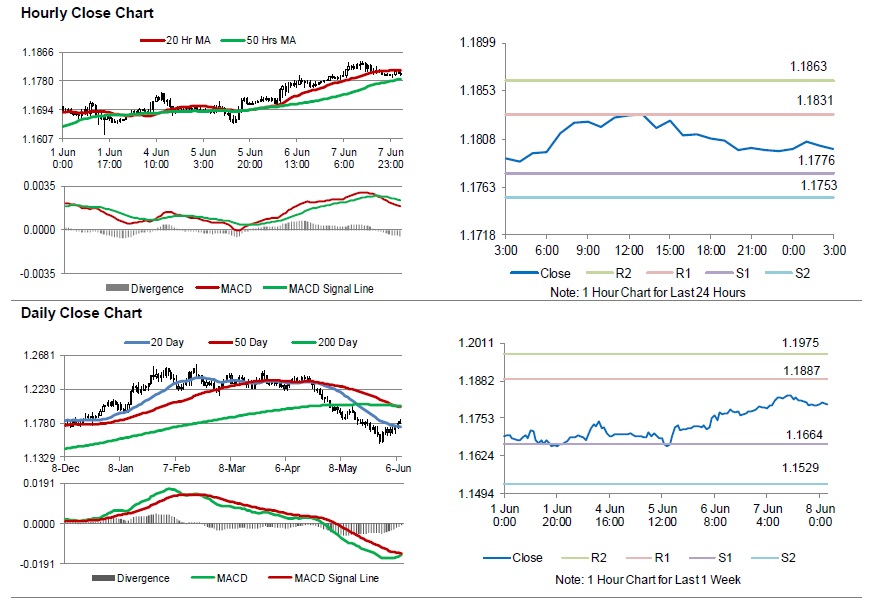

In the Asian session, at GMT0300, the pair is trading at 1.1799, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1776, and a fall through could take it to the next support level of 1.1753. The pair is expected to find its first resistance at 1.1831, and a rise through could take it to the next resistance level of 1.1863.

Amid lack of major macroeconomic releases in the Eurozone today, investors would look forward to Germany’s trade balance and industrial production, both for April, scheduled to release in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.