For the 24 hours to 23:00 GMT, the EUR declined 0.27% against the USD and closed at 1.1143.

Data showed that Euro-zone’s seasonally adjusted second estimate of gross domestic product (GDP) rose 0.2% on a quarterly basis in 2Q19, in line with market expectations. GDP had registered a rise of 0.4% in the previous quarter. The preliminary figures had also recorded a rise of 0.2%.

On the flipside, the region’s seasonally adjusted industrial production fell 1.6% on a monthly basis in June, declining by the most since February 2016 and slightly more than market expectations for a decline of 1.5%. In the prior month, industrial production had recorded a revised rise of 0.8%.

Separately, in Germany, the seasonally adjusted preliminary gross domestic product (GDP) eased 0.1% on a quarterly basis in 2Q 2019, meeting market expectations. In the prior quarter, the GDP had recorded a rise of 0.4%.

In the US, data indicated that MBA mortgage applications surged 21.7% on a weekly basis in the week ended 09 August 2019, following a rise 5.3% in the previous week.

In the Asian session, at GMT0300, the pair is trading at 1.1144, with the EUR trading marginally higher against the USD from yesterday’s close.

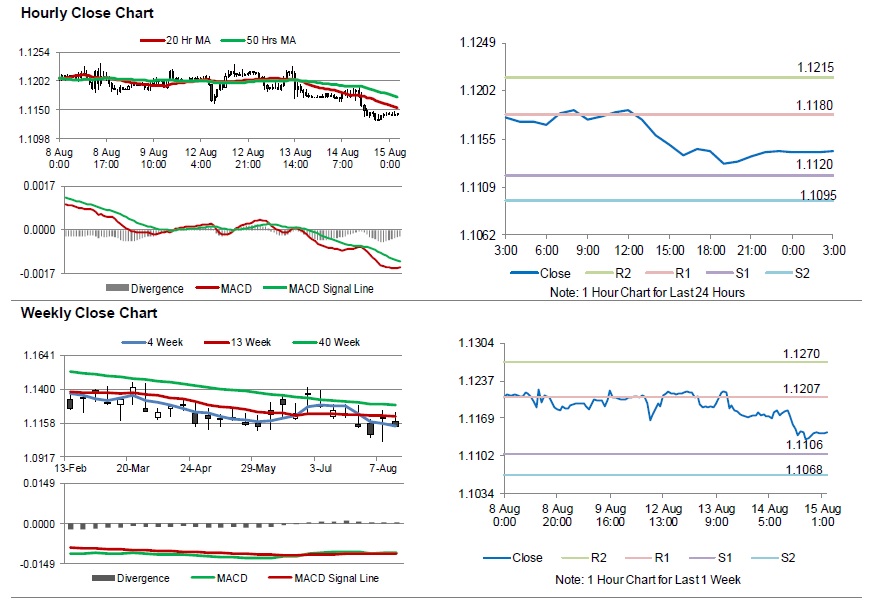

The pair is expected to find support at 1.1120, and a fall through could take it to the next support level of 1.1095. The pair is expected to find its first resistance at 1.1180, and a rise through could take it to the next resistance level of 1.1215.

Amid lack of macroeconomic releases in the Euro-zone today, traders would await the US Empire State manufacturing index, the Philadelphia Fed Business Outlook and the NAHB housing market index, all for August, while advance retail sales, industrial production and manufacturing (sic) production, all for July along with initial jobless claims, set to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.