For the 24 hours to 23:00 GMT, the EUR rose 0.55% against the USD and closed at 1.2451, after the seasonally adjusted second estimate of the Euro-zone’s gross domestic product (GDP) climbed 0.6% on a quarterly basis in the fourth quarter of 2017, confirming the preliminary print, thus suggesting that the region continued to witness strong growth in the final months of last year. In the prior quarter, GDP had registered a revised rise of 0.7%.

Additionally, the region’s seasonally adjusted industrial production registered a rise of 0.4% on a monthly basis in December, higher than market expectations for a rise of 0.1%, amid a rise in the output of durable goods and intermediate goods. In the previous month, industrial production had risen by a revised 1.3%.

Separately, preliminary data revealed that economic activity in Germany expanded 0.6% on a quarterly basis in the three months to December 2017, meeting market expectations, owing to a strong pick-up in exports. In the prior quarter, GDP had climbed 0.8%. Moreover, the nation’s final consumer price index (CPI) rose 1.6% on an annual basis in January, in line with the flash estimate. The CPI had registered a rise of 1.7% in the previous month.

The US Dollar declined against a basket of major currencies, after latest US economic releases painted a mixed picture of the health of the nation’s economy.

Data indicated that consumer price inflation in the US jumped more-than-anticipated by 0.5% on a monthly basis in January, marking its sharpest increase in 5 months, thus offering signs of firming inflation that could force the Federal Reserve (Fed) to move aggressively in raising interest rates. In the prior month, the CPI had registered a revised rise of 0.2%, while markets were anticipating for a gain of 0.3%.

On the other hand, the nation’s advance retail sales recorded an unexpected drop of 0.3% in January, dipping to its lowest in nearly a year. Retail sales had registered a revised flat reading in the previous month, while investors had envisaged for a rise of 0.2%. Also, the nation’s MBA mortgage applications retreated 4.1% in the week ended 09 February, after recording an increase of 0.7% in the previous week.

In other economic news, business inventories in the US grew 0.4% on a monthly basis in December, topping market expectations for a gain of 0.3%. In the prior month, business inventories had registered a similar rise.

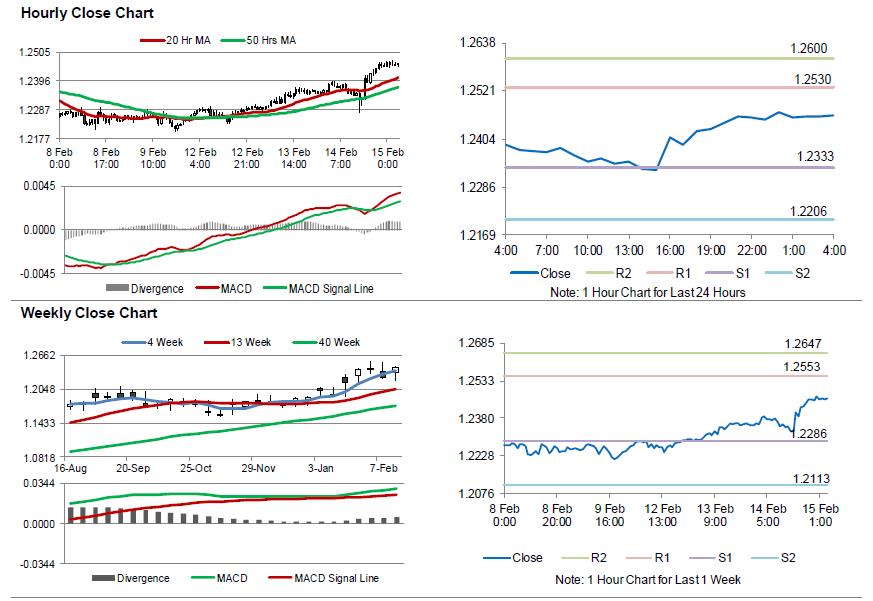

In the Asian session, at GMT0400, the pair is trading at 1.2460, with the EUR trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2333, and a fall through could take it to the next support level of 1.2206. The pair is expected to find its first resistance at 1.2530, and a rise through could take it to the next resistance level of 1.2600.

Looking ahead, traders would keep a close watch on the Euro-zone’s trade balance data for December, slated to release in a few hours. Moreover, the US initial jobless claims followed by the industrial and manufacturing production data for January as well as the NAHB housing market index for February, all scheduled to release later in the day, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.