For the 24 hours to 23:00 GMT, the EUR remained unchanged against the USD and closed at 1.1316.

Data indicated that the Euro-zone’s seasonally adjusted second estimate of gross domestic product (GDP) advanced at its weakest pace in four years by 0.2% on a quarterly basis in 3Q 2018, in line with market expectations and confirming the preliminary figures. The GDP had advanced 0.4% in the prior quarter. On the contrary, the region’s seasonally adjusted industrial production slid 0.3% on a monthly basis in September, less than market expectations for a fall of 0.4%. Industrial production had recorded a gain of 1.0% in the previous month.

Separately, in Germany, the seasonally adjusted preliminary gross domestic product (GDP) eased 0.2% on a quarterly basis in the third quarter of 2018, shrinking for the first time since 2015 and higher than market expectations for a fall of 0.1%. In the preceding quarter, the GDP had recorded a rise of 0.5%.

In the US, data showed that the US consumer price index (CPI) climbed 2.5% on a yearly basis in October, in line with market expectations and notching its highest level in 9-months. The CPI had recorded an increase of 2.3% in the prior month. On the other hand, the nation’s MBA mortgage applications dropped to its lowest level in 18-years by 3.2% on a weekly basis in the week ended 09 November 2018, following a revised decline of 0.7% in the previous week.

In the Asian session, at GMT0400, the pair is trading at 1.1331, with the EUR trading 0.13% higher against the USD from yesterday’s close.

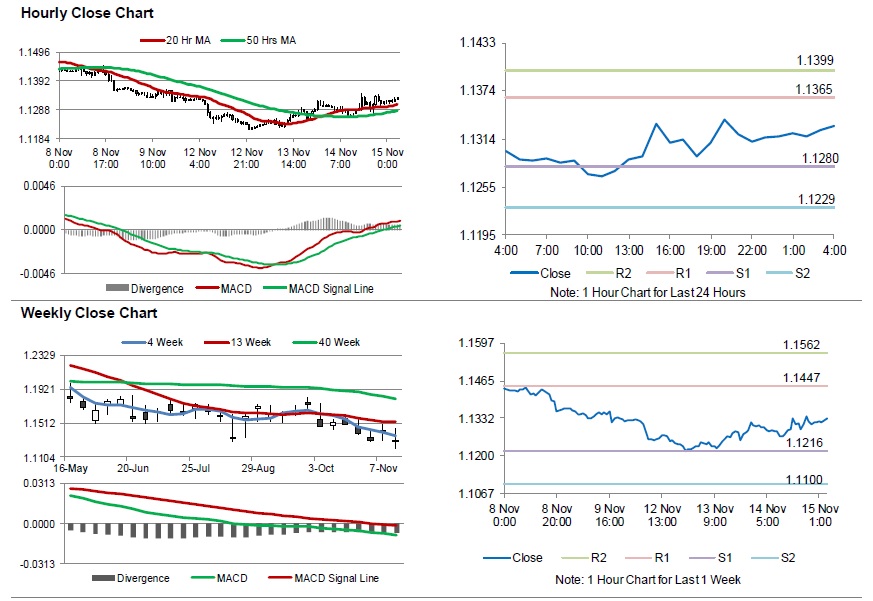

The pair is expected to find support at 1.1280, and a fall through could take it to the next support level of 1.1229. The pair is expected to find its first resistance at 1.1365, and a rise through could take it to the next resistance level of 1.1399.

Looking ahead, traders will closely monitor the Euro-zone’s trade balance data for September, slated to release in a few hours. Later in the day, the US Empire state manufacturing index, advance retail sales and the Philadelphia Fed business outlook, all for November, along with business inventories for September will keep investors on their toes. Also, the US initial jobless claims, will pique significant amount of investors’ attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.