For the 24 hours to 23:00 GMT, the EUR declined 0.3% against the USD and closed at 1.1826, after the European Central Bank (ECB) President, Mario Draghi, pledged to keep interest rates at record low for an extended period of time, and well past the end of its bond-buying programme, in order to promote solid economic growth within the Eurozone. Draghi also defended the central bank’s aggressive monetary policies, noting that it has been a success.

On the macro front, the Euro-zone’s seasonally adjusted industrial production rose above market expectations by 1.4% on a monthly basis in August, advancing to its highest since November 2016, thus underlining the common currency region’s improving growth prospects. In the prior month, industrial production had registered a revised rise of 0.3%, while markets had anticipated for a gain of 0.6%.

Macroeconomic data indicated that first time claims for the US unemployment benefits dropped more-than-expected to a level of 243.0K in the week ended 07 October, hitting its lowest in more than a month. Markets had expected initial jobless claims to drop to a level of 250.0K, after recording a revised reading of 258.0K in the prior week. Moreover, the nation’s producer price index climbed 0.4% MoM in September, meeting market expectations and compared to a rise of 0.2% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1850, with the EUR trading 0.2% higher against the USD from yesterday’s close.

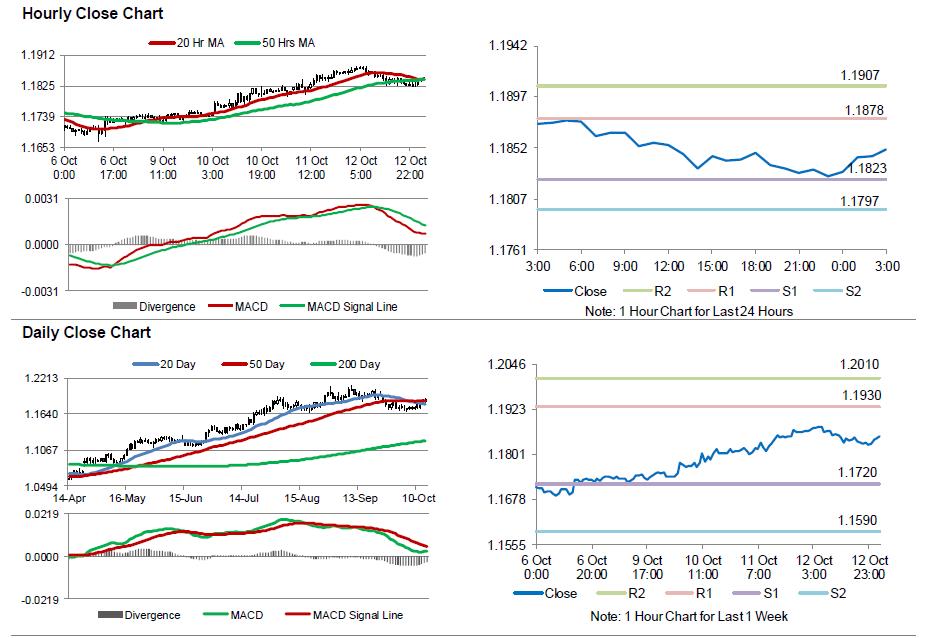

The pair is expected to find support at 1.1823, and a fall through could take it to the next support level of 1.1797. The pair is expected to find its first resistance at 1.1878, and a rise through could take it to the next resistance level of 1.1907.

Moving ahead, traders will eye Germany’s consumer price inflation data for September, slated to release in a few hours. Moreover, investors will keenly watch the US inflation data for September, to gauge the likelihood of another Federal Reserve interest rate hike this year.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.