For the 24 hours to 23:00 GMT, the EUR rose 0.22% against the USD and closed at 1.1629.

On the data front, Euro-zone’s industrial production unexpectedly slid 0.1% on an annual basis in July, defying market consensus for an advance of 1.0%. In the prior month, industrial production had registered a revised rise of 2.3%.

Separately, the dollar fell against a basket of other currencies, following reports that the US and China would resume trade talks.

In the US, data showed that the producer price advanced 2.8% on a yearly basis in August, undershooting market expectations for a rise of 3.2%. In the previous month, the index had registered a gain of 3.3%. On the contrary, the nation’s mortgage applications dipped 1.8% on a weekly basis in the week ended 07 September 2018, registering its lowest level in 18 years. In the preceding week, mortgage applications had fallen 0.1%.

Separately, according to the Federal Reserve’s (Fed) Beige Book report, the overall US economy expanded at a “moderate” pace in August, except for three districts, which exhibited comparatively weaker growth. Moreover, it revealed that Trump administration’s tariff policies led to a slowdown in businesses and a tight job market created labour shortages across the country. However, the Fed remains optimistic about the near-term outlook for businesses.

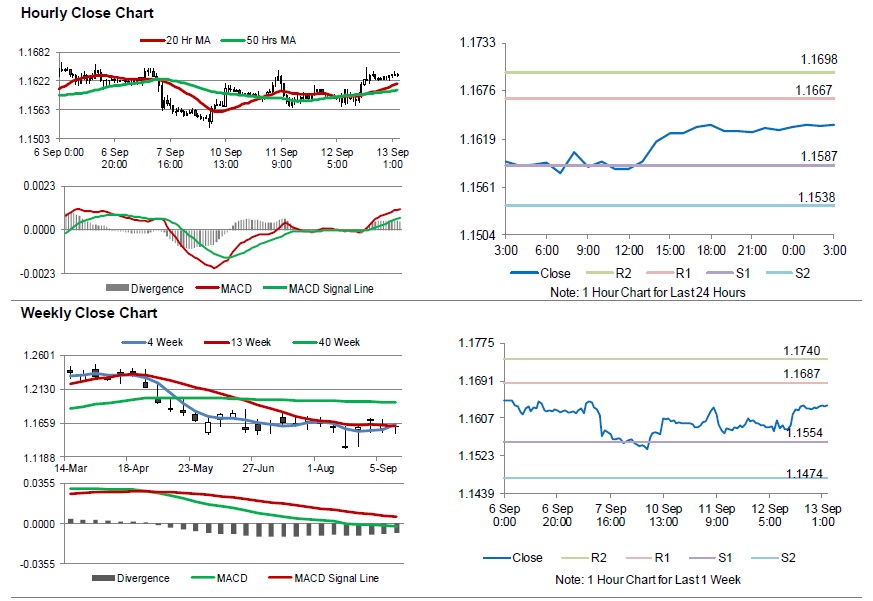

In the Asian session, at GMT0300, the pair is trading at 1.1635, with the EUR trading 0.05% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1587, and a fall through could take it to the next support level of 1.1538. The pair is expected to find its first resistance at 1.1667, and a rise through could take it to the next resistance level of 1.1698.

Going forward, investors would keep an eye on the European Central Bank’s (ECB) interest rate decision followed by the ECB President, Mario Draghi’s speech, due in a few hours. Also, Germany’s consumer price index for August, due to be released in a while, will keep traders on their toes. Later in the day, the US consumer price index and monthly budget statement, both for August along with initial jobless claims, will pique significant amount of investors’ attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.