For the 24 hours to 23:00 GMT, the EUR declined 0.46% against the USD and closed at 1.0923.

On the data front, the Euro-zone’s Sentix investor confidence index rose more-than-expected to a level of 27.4 in May, notching its highest level since July 2007, as investors grew optimistic about the region’s current economic outlook and as worries over political populism across the Euro bloc ebbed. The index had registered a reading of 23.9 in the prior month, while investors had envisaged for an advance to a level of 25.2.

Elsewhere, in Germany, the seasonally adjusted factory orders advanced 1.0% MoM in March, rising for second straight month and surpassing market expectations for a gain of 0.7%. Factory orders had registered a revised gain of 3.5% in the previous month.

In the US, data indicated that the labour market conditions index climbed to a level of 3.5 in April, after recording a revised rise of 3.6 in the previous month and compared to market expectations for an advance to a level of 1.0.

In the Asian session, at GMT0300, the pair is trading at 1.0926, with the EUR trading marginally higher against the USD from yesterday’s close.

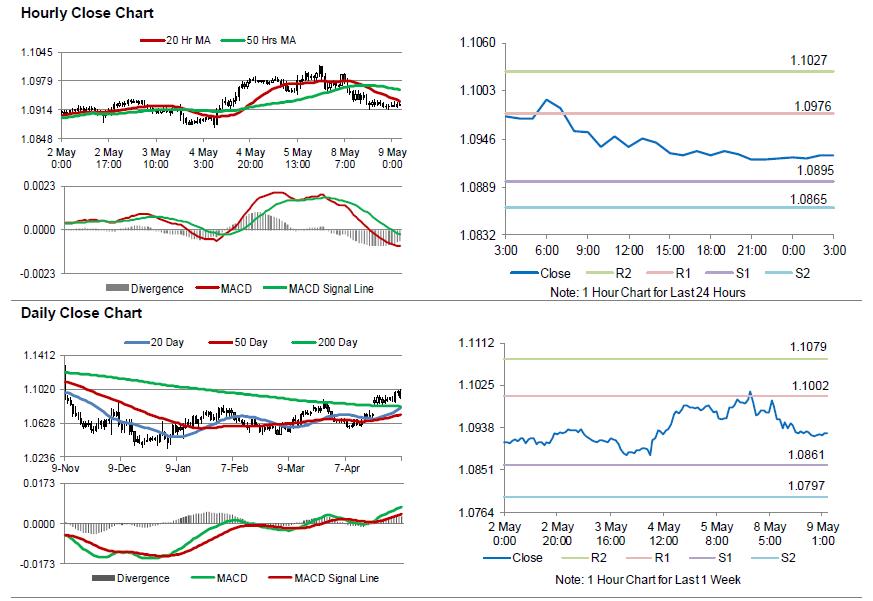

The pair is expected to find support at 1.0895, and a fall through could take it to the next support level of 1.0865. The pair is expected to find its first resistance at 1.0976, and a rise through could take it to the next resistance level of 1.1027.

Moving ahead, market participants focus on Germany’s trade balance and industrial production data, both for March, slated to release in a few hours. Moreover, in the US, final wholesale inventories and JOLTS job openings, both for March along with the NFIB small business optimism index for April, will be eyed by investors.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.