For the 24 hours to 23:00 GMT, the EUR traded flat against the USD and closed at 1.1794.

On the macro front, the Euro-zone’s Sentix investor confidence index dropped to a three-month low level of 27.7 in August. The index had registered a reading of 28.3 in the prior month, while markets expected it to nudge down to a level of 27.6.

Separately, Germany’s seasonally adjusted industrial production unexpectedly eased 1.1% on a monthly basis in June, dropping for the first time in six months and confounding market expectations for a rise of 0.2%. In the previous month, industrial production had registered a rise of 1.2%.

In the US, data showed that consumer credit rose less-than-expected by $12.39 billion in June, after increasing by a revised $18.29 billion in the previous month, while markets were anticipating it to advance $15.75 billion.

Meanwhile, St. Louis Fed President, James Bullard, reiterated that low interest rates are “likely to remain appropriate” over the near-term, as inflation is set to remain at the current low levels even if the US job market continues to improve.

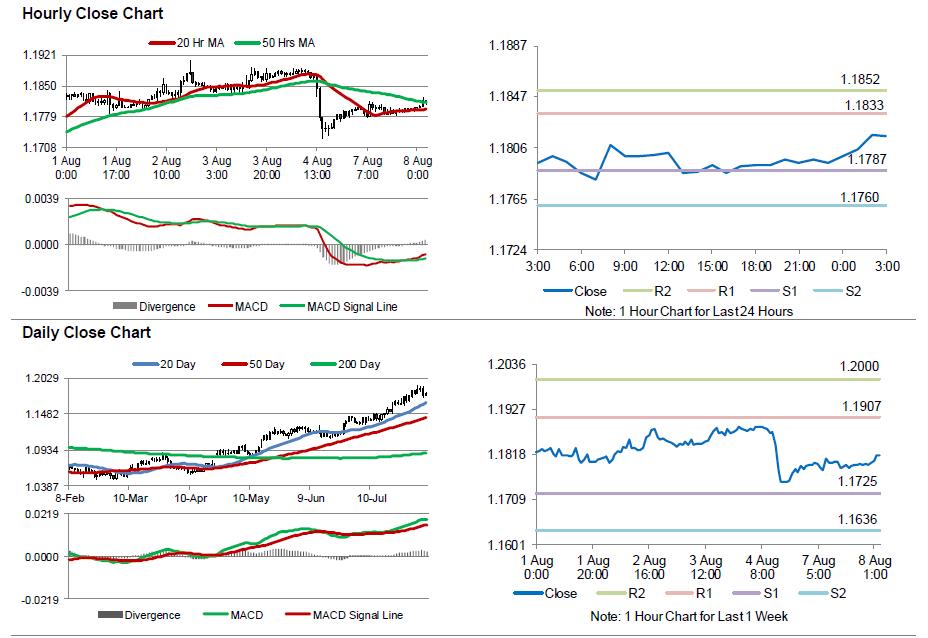

In the Asian session, at GMT0300, the pair is trading at 1.1815, with the EUR trading 0.18% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1787, and a fall through could take it to the next support level of 1.1760. The pair is expected to find its first resistance at 1.1833, and a rise through could take it to the next resistance level of 1.1852.

Moving ahead, investors will look forward to Germany’s trade balance figures for June, slated to release in a while. Additionally, the US NFIB small business optimism index for July, scheduled to release in a few hours, will be eyed by traders.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.