For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.1870, after the Euro-zone’s Sentix investor confidence index fell more-than-anticipated to a level of 31.1 in December. The index had recorded a 17-year high level of 34.0 in the prior month. Market participants had anticipated the index to fall to a level of 33.4.

On the macro front, in the US, data revealed that final durable goods orders dropped less than initially estimated by 0.8% MoM in October, compared to a revised rise of 2.2% in the previous month, while the preliminary figures had indicated a fall of 1.2%. Moreover, the nation’s factory orders eased less-than-expected by 0.1% on a monthly basis in October, compared to market consensus for a drop of 0.4%. Factory orders had climbed by a revised 1.7% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1874, with the EUR trading a tad higher against the USD from yesterday’s close.

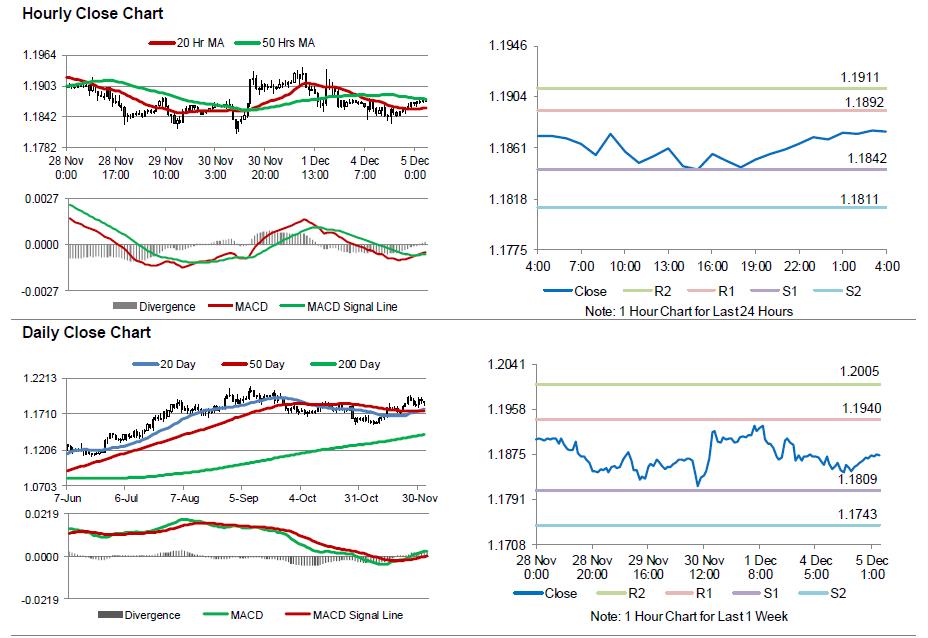

The pair is expected to find support at 1.1842, and a fall through could take it to the next support level of 1.1811. The pair is expected to find its first resistance at 1.1892, and a rise through could take it to the next resistance level of 1.1911.

Ahead in the day, market participants would eye the release of final Markit services PMI for November across the Euro-zone along with the region’s retail sales data for October. Later in the day, investors would focus on the US trade balance figures for October, followed by the ISM non-manufacturing and the final Markit services PMIs, both for November.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.