For the 24 hours to 23:00 GMT, the EUR rose 0.24% against the USD and closed at 1.1183.

On the macro front, the Euro-zone’s manufacturing PMI unexpectedly contracted to a level of 47.7 in May, defying market expectations for a rise to a level of 48.1. In the previous month, the PMI had registered a level of 47.9. Moreover, the region’s preliminary services PMI surprisingly slid to a level of 52.5, compared to a level of 52.8 in the prior month. Market participants had envisaged for the PMI to register a gain to a level of 53.0.

The European Central Bank (ECB), in its latest monetary policy meeting minutes, showed declining confidence in growth recovery and indicated that the Eurozone’s economic growth would be weaker than expected. Meanwhile, the officials called for more support for the economy, but argued that more analysis was needed to see if the rapid loss of economic momentum is persistent or temporary. Moreover, the central bank reiterated that it would finalise the further course of action of the targeted longer-term refinancing operations (TLTROs) in the forthcoming policy meetings.

Separately, in Germany, the final gross domestic product (GDP) advanced 0.4% on a quarterly basis in 1Q19, meeting market expectations. In the previous quarter, GDP had registered an unchanged reading. The preliminary figures had also indicated a rise of 0.4%. On the other hand, the nation’s Markit manufacturing PMI unexpectedly dropped to a level of 44.3 in May, defying market anticipation for a rise to a level of 44.8. The PMI had registered a reading of 44.4 in the prior month. Further, the preliminary services PMI declined to a level of 55.0 in May, compared to a level of 55.7 in the preceding month. Market had expected the services PMI to ease to a level of 55.4. Additionally, the nation’s Ifo business climate index eased to a 4-year low level of 97.9 in May, more than market expectations for a fall to a level of 99.1. The index had recorded a level of 99.2 in the prior month. Also, the Ifo current assessment index unexpectedly fell to a level of 100.6 in May, defying market anticipations for an increase to a level of 103.5. In the prior month, the index had registered a revised level of 103.4. Meanwhile, the Ifo business expectations index remained unchanged at 95.3 in May.

In the US, data showed that the Markit manufacturing PMI unexpectedly drop to a 9-year low level of 50.6 in May, reflecting the effects of ongoing trade war and compared to a reading of 52.6 in the previous month. Market participants had envisaged the PMI to remain unchanged. Likewise, the nation’s services PMI unexpectedly fell to a level of 50.9 in May, defying market expectations for an advance to a level of 53.5. The PMI had registered a reading of 53.0 in the previous month. Furthermore, the US new home sales plunged 6.9% on monthly basis, to a level of 673.0K in April, compared to market consensus for a reading of 675.0K. New home sales had registered a revised reading of 723.0K in the prior month. Meanwhile, the number Americans filling for unemployment benefits unexpectedly slid to a level of 211.0K in the week ended 18 May 2019, confounding market anticipations for a rise to a level of 215.0K. In the prior week, initial jobless claims had registered a level of 212.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1182, with the EUR trading marginally lower against the USD from yesterday’s close.

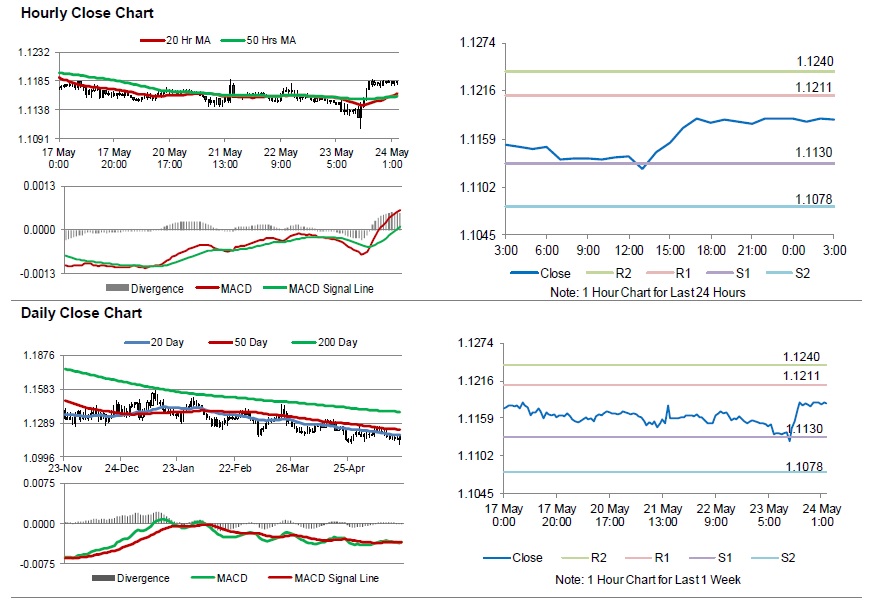

The pair is expected to find support at 1.1130, and a fall through could take it to the next support level of 1.1078. The pair is expected to find its first resistance at 1.1211, and a rise through could take it to the next resistance level of 1.1240.

Amid no major economic releases in the Euro-zone today, investors would focus on the US durable goods orders for April, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.