For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.1260.

Data showed that the Euro-zone’s flash manufacturing PMI climbed to a level of 47.8 in April, compared to a reading of 47.5 in the prior month. Market participants had expected the PMI to record an advance to a level of 48.0. Meanwhile, preliminary services PMI fell more than expected to a level of 52.5 in April. In the previous month, the PMI had registered a reading of 53.3.

Separately, in Germany, the Markit manufacturing PMI advanced to a level of 44.5 in April, contracting for the fourth consecutive month and compared to a level of 44.1 in the previous month. Market participants had envisaged the PMI to rise to a level of 45.0. Furthermore, the nation’s flash services PMI unexpectedly climbed to a seven-month high level of 55.6 in April. In the prior month, the PMI had recorded a reading of 55.4.

On the other hand, Germany’s producer price index (PPI) unexpected fell by 0.1% on a monthly basis in March. The PPI had registered a similar fall in the previous month.

In the US, data indicated that advance retail sales jumped 1.6% on a yearly basis in March, notching its highest level in 2.5 years, supported by good weather conditions. In the previous month, the retails sales had recorded a fall of 0.2%, while markets had anticipated retail sales to climb 1.0%. Moreover, the seasonally adjusted initial jobless claims unexpectedly eased to a level of 192.0K. Initial jobless claims had recorded a revised reading of 197.0K in the prior week. Also, the Chicago Fed national activity index advanced to a level of -0.15 in March, following a revised reading of -0.31 in the prior month. Meanwhile, the nation’s flash Markit manufacturing PMI remained flat at a level of 52.4 in April, compared to market expectations of a rise to a level of 52.8.

On the contrary, the US preliminary Markit services PMI dropped more than expected to a level of 52.9 in April. In the prior month, the PMI had registered a reading of 55.3. Moreover, the Philadelphia Fed manufacturing index dropped to a level of 8.5 in April, more than market expectations for a fall to a level of 11.0. The index had recorded a level of 13.7 in the prior month. Additionally, the US building permits surprisingly eased by 1.7%, on monthly basis, to an annual rate of 1269.0K in March, compared to a revised level of 1291.0K in the previous month. Moreover, the nation’s housing starts unexpectedly slid 0.3% on monthly basis, to an annual rate of 1139.0K in March, reaching a two-year low level and following a revised reading of 1142.0K in the previous month. Market participants had anticipated housing starts to advance to a level of 1230.0K. Likewise, the US existing home sales declined 4.9% to a level of 5.2 million on monthly basis in March, falling short market expectations of 5.3 million. Existing home sales had recorded a revised level of 5.5 million in the prior month.

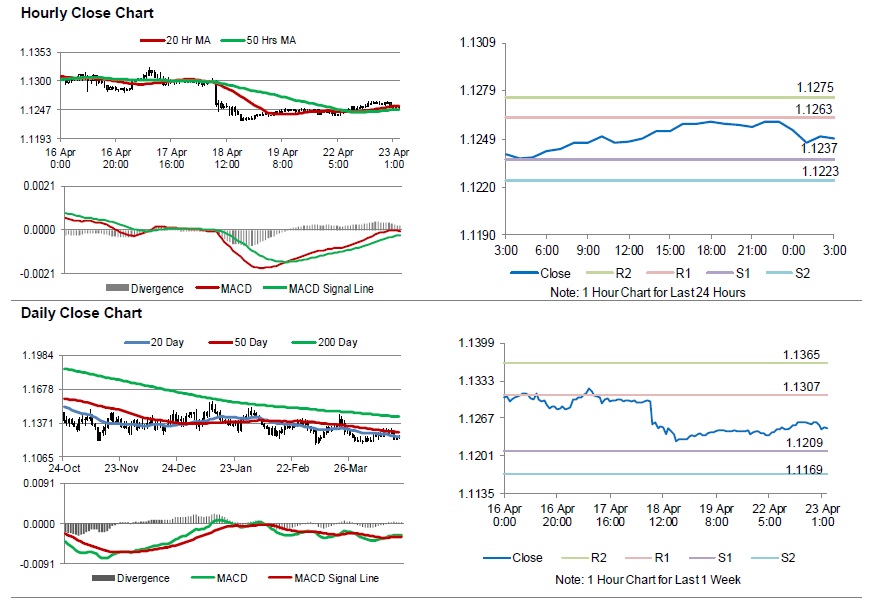

In the Asian session, at GMT0300, the pair is trading at 1.1250, with the EUR trading 0.09% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1237, and a fall through could take it to the next support level of 1.1223. The pair is expected to find its first resistance at 1.1263, and a rise through could take it to the next resistance level of 1.1275.

Moving ahead, investors would keep an eye on the Euro-zone’s consumer confidence index for April, slated to release in a few hours. Later in the day, the US house price index for February, the Richmond Fed manufacturing index for April and new home sales for March, will keep traders on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.