For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.1460 on Friday.

On the macro front, Euro-zone’s final Markit manufacturing PMI declined in line with market expectations to a level of 50.5 in January, marking its lowest level since November 2014 and thereby signalling the likelihood of recession. The preliminary figures had also indicated a fall to a level of 50.5. In the previous month, the PMI had recorded a reading of 51.4. Additionally, the nation’s consumer price inflation slowed to 1.4% on an annual basis in January, notching its lowest level in nine months and at par with market expectations. In the prior month, inflation had recorded a level of 1.6%.

Separately, in Germany, the final Markit manufacturing PMI eased o a level of 49.7 in January, more than market forecast for a drop to a level of 49.9. The preliminary figures had indicated a fall to a level of 49.9. In the previous month, the manufacturing PMI had recorded a reading of 51.5.

In the US, data showed that non-farm payrolls climbed by 304.0K in January, surpassing market expectations for a rise of 165.0K and recording its largest gain since February 2018. Non-farm payrolls had registered a revised increase of 222.00K in the prior month. Additionally, average hourly earnings of all employees increased 3.2% on a yearly basis in January, in line with market expectations. Average hourly earnings of all employees had registered a similar rise in the previous month. The final Markit manufacturing PMI climbed to 54.9 in January, meeting market expectations and confirming the preliminary print. In the previous month, the Markit manufacturing PMI had recorded a level of 53.8. Moreover, the ISM manufacturing activity index advanced to a level of 56.6 in January, compared to a revised reading of 54.3 in the prior month. Furthermore, construction spending registered a more-than-anticipated rise of 0.8% on a monthly basis in November. In the prior month, construction spending had advanced by a revised 0.1%. The final Michigan consumer sentiment index fell to 91.2 in January, less than market expectations for a decline to a level of 90.8. The index had recorded a reading of 98.3 in the prior month. The preliminary figures had recorded a drop to 90.7. Meanwhile, unemployment rate unexpectedly rose to a seven-month high of 4.0% in January, defying market expectations for an unchanged reading and compared to a rate of 3.9% in the previous month.

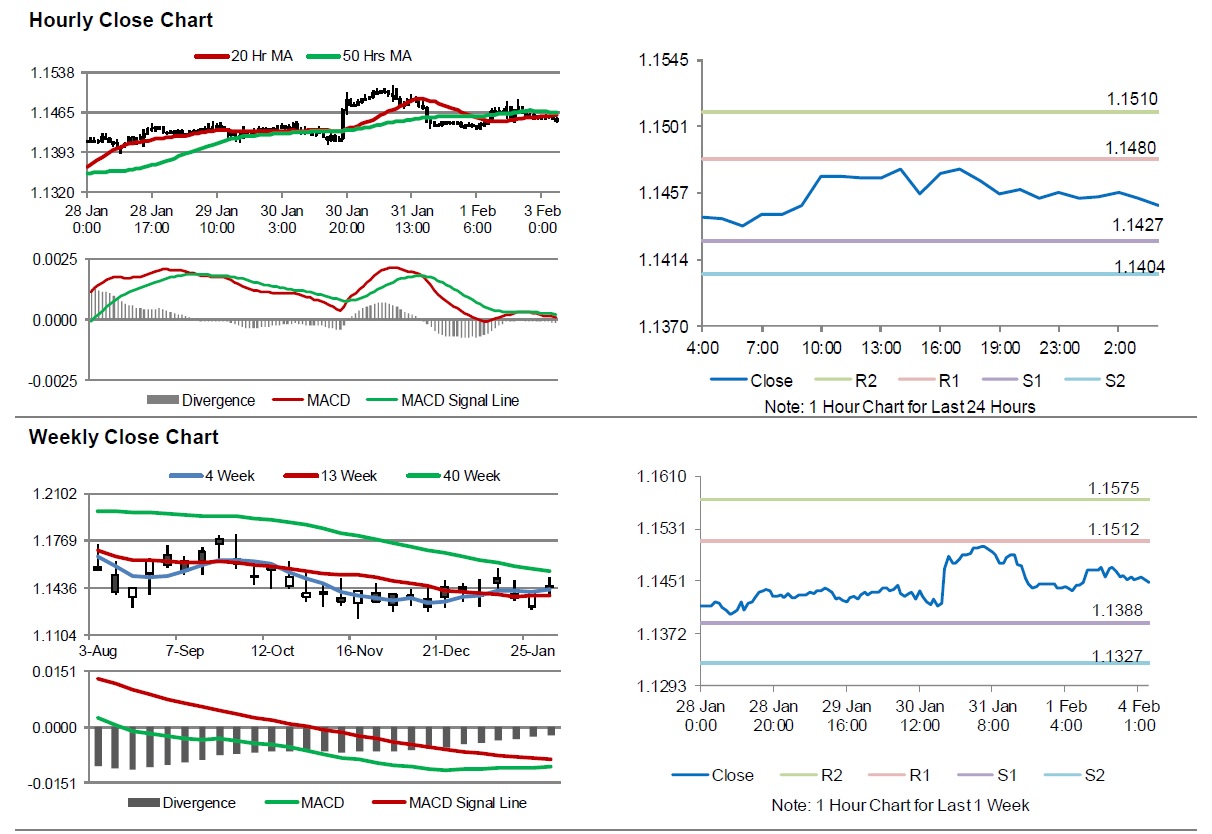

In the Asian session, at GMT0400, the pair is trading at 1.1449, with the EUR trading 0.10% lower against the USD from Friday’s close.

The pair is expected to find support at 1.1427, and a fall through could take it to the next support level of 1.1404. The pair is expected to find its first resistance at 1.1480, and a rise through could take it to the next resistance level of 1.1510.

Moving ahead, investors would closely monitor Euro-zone’s Sentix investor confidence for February and the producer price index for December, slated to release in a few hours. Later in the day, the US factory orders and durable goods orders, both for November, will keep investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.