For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.1765, buoyed by a stronger-than-expected reading on the Euro-zone manufacturing sector.

Data showed that the Euro-zone’s preliminary Markit manufacturing PMI unexpectedly climbed to a level of 58.6 in October, hitting its highest level since February 2011 and suggesting that manufacturing sector will continue to propel growth in the common currency region. Markets had expected the PMI to fall to a level of 57.8, after recording a reading of 58.1 in the previous month. On the contrary, the region’s flash Markit services PMI declined more-than-anticipated to a level of 54.9 in October, expanding at its weakest pace in two months. The PMI had recorded a reading of 55.8 in the prior month, while investors had envisaged for a fall to a level of 55.6.

Separately, activity in Germany’s manufacturing sector slightly eased to a level of 60.5 in October, against market consensus for a fall to a level of 60.0. In the previous month, the PMI had recorded a reading of 60.6. Meanwhile, the nation’s services sector growth slowed to a level of 55.2 in October, more than market expectations for a drop to a level of 55.5 and following a reading of 55.6 in the previous month.

The greenback gained ground against a basket of major currencies, driven by reports that Republican Senators are leaning towards John Taylor to be the next head of the Federal Reserve.

Gains in the US Dollar were supported further, following a pair of upbeat economic releases in the US that pointed towards improving economic conditions in the world’s largest economy.

The flash Markit manufacturing PMI in the US advanced to a nine-month high level of 54.5 in October, topping market expectations for a rise to a level of 53.4 and following a reading of 53.1 in the previous month. Further, the nation’s preliminary Markit services PMI recorded an unexpected rise to a level of 55.9 in October, expanding at its quickest pace in eight months. Markets had expected the PMI to fall to a level of 55.2, compared to a level of 55.3 in the prior month.

Other data indicated that the nation’s Richmond Fed manufacturing index sharply eased to a level of 12.0 in October, compared to a reading of 19.0 in the previous month, while market participants had anticipated for a drop to a level of 17.0.

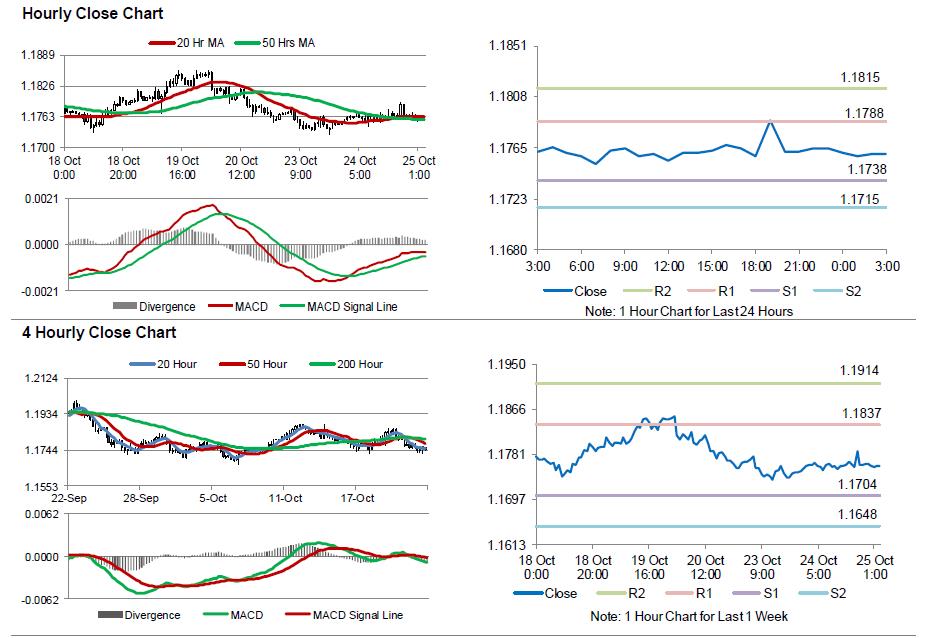

In the Asian session, at GMT0300, the pair is trading at 1.1760, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1738, and a fall through could take it to the next support level of 1.1715. The pair is expected to find its first resistance at 1.1788, and a rise through could take it to the next resistance level of 1.1815.

Moving ahead, investors would eye Germany’s Ifo expectations and business climate indices for October, slated to release in a few hours. Moreover, the US flash durable goods orders and new home sales, both for September, set to release later in the day, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.