For the 24 hours to 23:00 GMT, the EUR declined 0.38% against the USD and closed at 1.1658 on Friday, following downbeat economic data.

Data showed that Euro-zone’s t final manufacturing PMI fell to a level of 55.5 in May, at par with market expectations. The preliminary figures had also indicated a fall to 55.50. The PMI had recording a level of 56.2 in the prior month. Meanwhile, in Germany, the final manufacturing PMI declined to a level of 56.9 in May, hitting a 15-month low, after registering a level of 58.1 in the previous month. Markets had expected the PMI to fall to a level of 56.8. The preliminary figures had recorded a drop to 56.8.

On Friday, the US Dollar climbed against a basket of currencies, following upbeat US jobs data and as trade war fears eased.

In the US, data revealed that unemployment rate unexpectedly slid to a rate of 3.8% in May, touching an 18-year low. In the previous month, unemployment rate had recorded a reading of 3.9%.

Additionally, the nation’s average hourly earnings advanced 0.3% on a monthly basis in May, higher than market expectations. In the preceding month, average hourly earnings recorded a rise of 0.1%.

Further, the US non-farm payrolls increased to a level of 223.0K in May, exceeding market anticipations of an advance to a level of 190.0K. Non-farm payrolls had recorded a revised increase of 159.0K in the prior month.

On the data front, the US final Markit manufacturing PMI dropped surprisingly to a level of 56.4, compared to a level of 56.5 in the prior month. Markets were expecting PMI to climb to 56.6.

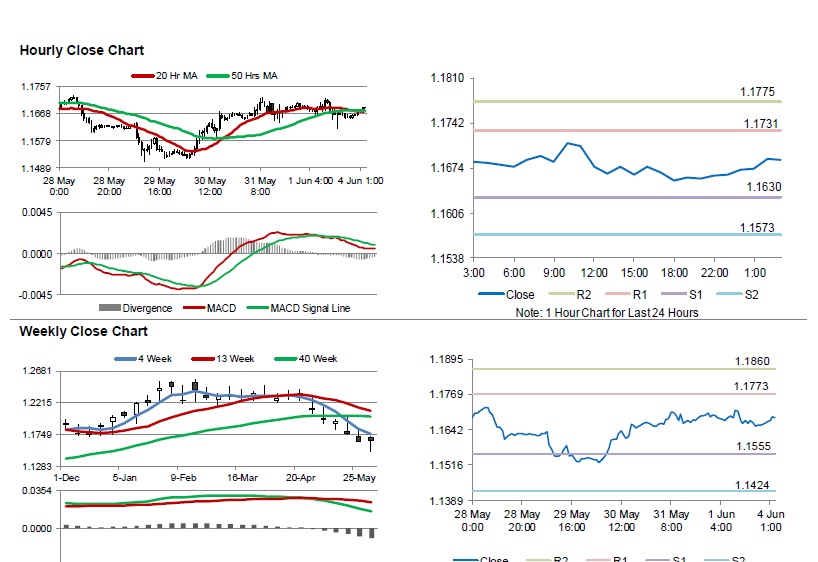

In the Asian session, at GMT0300, the pair is trading at 1.1687, with the EUR trading 0.25% higher against the USD from Friday’s close.

The pair is expected to find support at 1.1630, and a fall through could take it to the next support level of 1.1573. The pair is expected to find its first resistance at 1.1731, and a rise through could take it to the next resistance level of 1.1775.

Looking forward, investors would look forward Euro-zone’s Sentix investor confidence index for June and the producer price index for May, set to release in few hours. Also, the US durable goods orders for April, scheduled to release later in the day, will be on investors radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.