For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.1204.

In economic news, the Euro-zone’s producer price index (PPI) advanced 3.0% on a yearly basis in February, compared to a revised rise of 2.9% in the prior month. Market participants had envisaged the PPI to register a gain of 3.1%.

In the US, data indicated that the US durable goods orders retreated 1.6% on a monthly basis in February, amid steep fall in local aircraft orders and less than market consensus for a fall of 1.8%. In the prior month, durable goods orders had recorded a revised rise of 0.1%.

In the Asian session, at GMT0300, the pair is trading at 1.1221, with the EUR trading 0.15% higher against the USD from yesterday’s close.

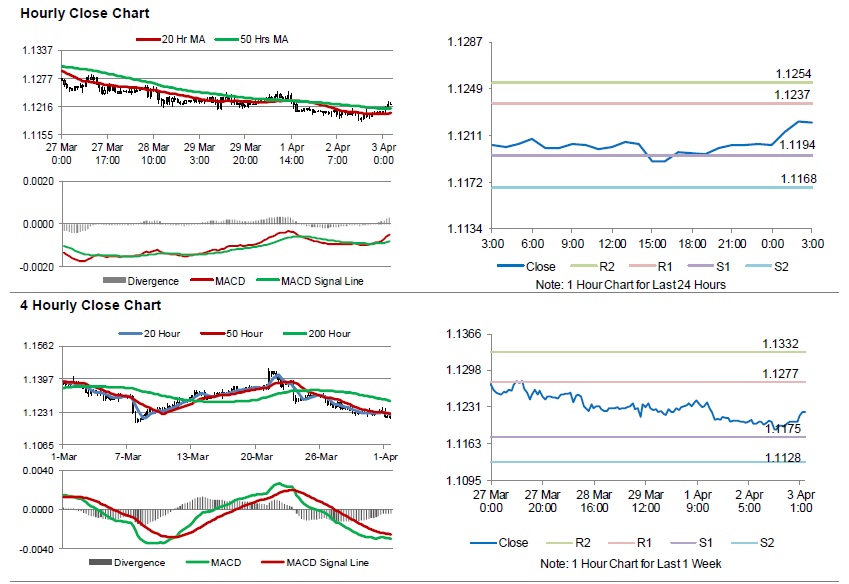

The pair is expected to find support at 1.1194, and a fall through could take it to the next support level of 1.1168. The pair is expected to find its first resistance at 1.1237, and a rise through could take it to the next resistance level of 1.1254.

Looking forward, traders would await the Euro-zone’s retail sales for February along with the Markit services PMI for March, set to release across the euro bloc. Later in the day, the US ADP employment change, the Markit services PMI and the ISM services PMI, all for March followed by the MBA mortgage applications, will garner significant amount of investors’ attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.