For the 24 hours to 23:00 GMT, the EUR rose 0.35% against the USD and closed at 1.1849.

In economic news, data indicated that the Euro-zone’s producer price index (PPI) advanced 2.5% on an annual basis in June, meeting market expectations and rising at its weakest pace this year. The PPI had risen by a revised 3.4% in the preceding month.

Macroeconomic data released in the US indicated that ADP’s private sector employment climbed less-than-expected by 178.0K in July, after jumping by a revised 191.0K in the prior month and missing market expectations for an advance of 190.0K. Additionally, the nation’s MBA mortgage applications slid 2.8% in the week ended 28 July, after recording a gain of 0.4% in the prior week.

Meanwhile, the St. Louis Fed President, James Bullard, stated that he would not be in favour of further rate hikes in the near-term as inflation remains at stubbornly low level. Meanwhile, the San Francisco Fed President, John Williams, signalled that the central bank could start rolling back its $4.5 trillion balance sheet this autumn.

In the Asian session, at GMT0300, the pair is trading at 1.1845, with the EUR trading a tad lower against the USD from yesterday’s close.

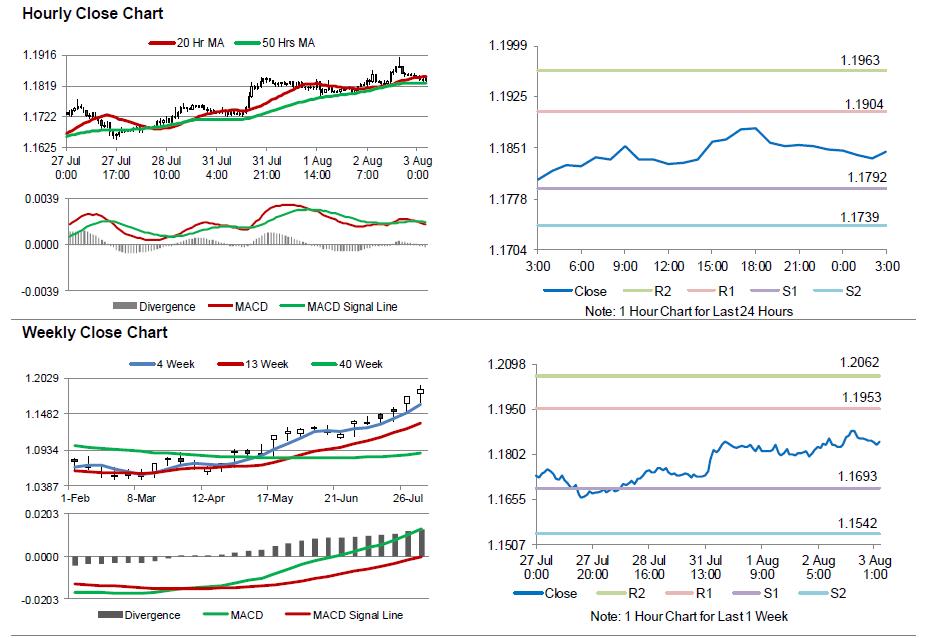

The pair is expected to find support at 1.1792, and a fall through could take it to the next support level of 1.1739. The pair is expected to find its first resistance at 1.1904, and a rise through could take it to the next resistance level of 1.1963.

Moving ahead, market participants will keep a close watch on the Euro-zone’s retail sales data for June and the final Markit services PMI for July across the Euro-zone, slated to release in a few hours. Moreover, traders will eye the US ISM non-manufacturing PMI as well as the final Markit services PMI, both for July coupled with factory orders and durable goods orders, both for June and initial jobless claims data, all slated to release later today.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.