For the 24 hours to 23:00 GMT, the EUR declined 0.39% against the USD and closed at 1.0796.

On the macro front, Euro-zone’s Markit services PMI dropped to 12.0 in April, compared to a level of 26.4 in the previous month. The preliminary figures had indicated a drop to 11.7. Additionally, seasonally adjusted retail sales slumped 11.2% on a monthly basis in March, more than market expectations for a drop of 8.0% and compared to a revised rise of 0.6% in the previous month. Separately, Germany’s factory orders plunged 15.6% on a monthly basis in March, marking its biggest fall since January 1991 and more than market consensus for a drop of 10.0%. In the earlier month, factory orders had recorded a revised fall of 1.2%. Moreover, the Markit services PMI declined to 16.2 in April, compared to a level of 31.7 in the previous month. The preliminary figures had recorded a fall to 15.9.

In the US, the MBA mortgage applications rose 0.1% in the week ended 01 May of 2020, compared to a drop of 3.3% in the earlier month. Moreover, the ADP employment dropped by 20236.0K in April, more than expectations and compared to a reading decline of 149.0K in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0800, with the EUR trading marginally higher against the USD from yesterday’s close.

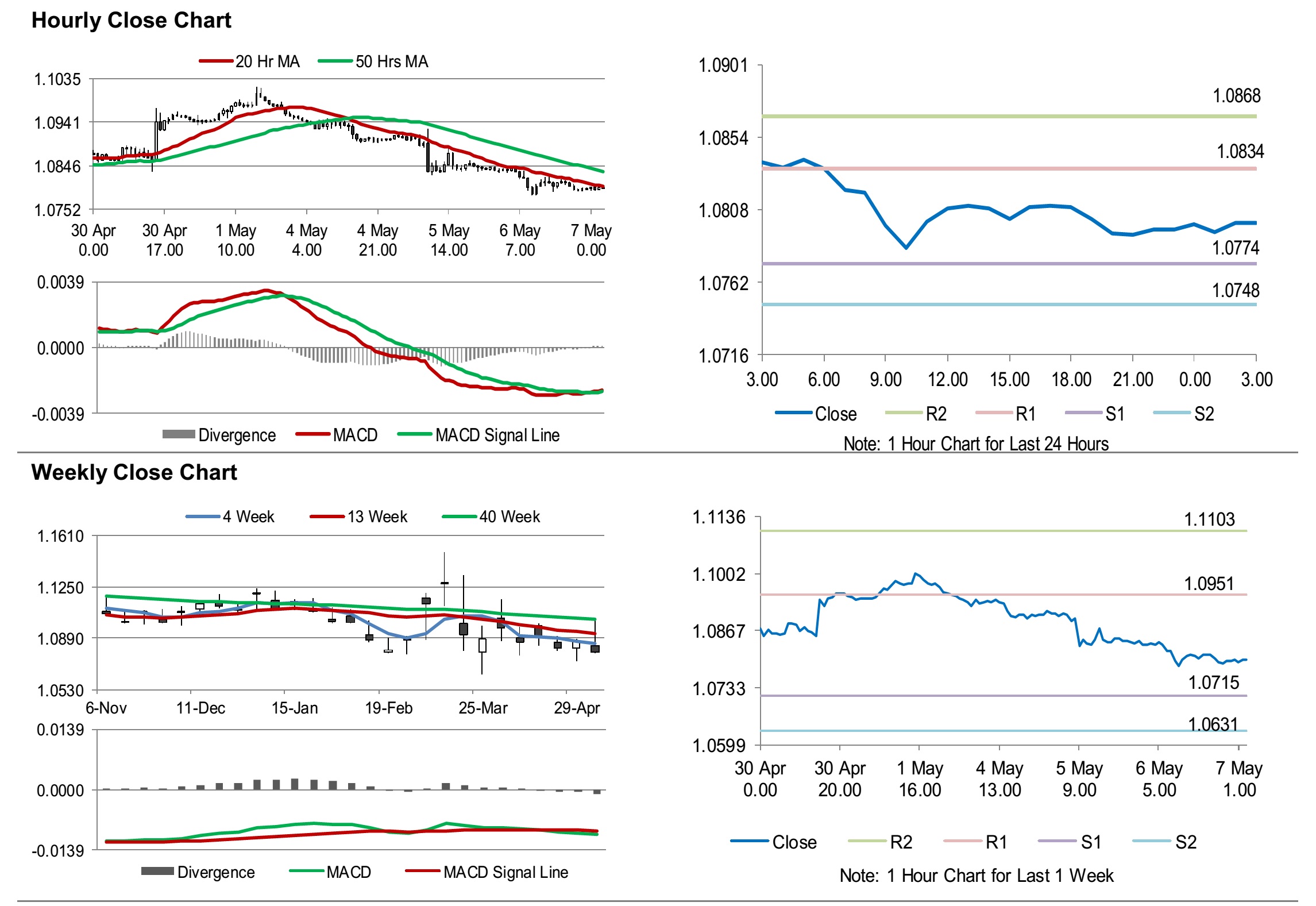

The pair is expected to find support at 1.0774, and a fall through could take it to the next support level of 1.0748. The pair is expected to find its first resistance at 1.0834, and a rise through could take it to the next resistance level of 1.0868.

Looking forward, investors would keep a watch on European Central Bank President, Lagarde’s speech, slated to release later today. Additionally, Germany’s industrial production for March, would keep investors on their toes. Later in the day, the US initial jobless claims along with the consumer credit change for March, will be eyed by traders.

The currency pair is showing convergence with its 20 Hr and trading below its 50 Hr moving average.