For the 24 hours to 23:00 GMT, the EUR declined 0.35% against the USD and closed at 1.1135.

Data showed that Euro-zone’s services PMI rose to 52.6 in February, compared to 52.5 in the previous month. The preliminary figures had indicated a rise to a level of 52.8. Moreover, retail sales advanced 0.6% on a monthly basis in January, in line with market consensus and compared to a revised fall of 1.1% in the prior month. Separately, Germany’s services PMI dropped to 52.5 in February, compared to 54.2 in the previous month. The preliminary figures had indicated a fall to a level of 53.3. Additionally, the nation’s retail sales rose 0.9% on a monthly basis in January, undershooting market expectations for a rise of 1.0% and compared to a revised drop of 3.3% in the previous month.

In the US, the ISM non-manufacturing PMI unexpectedly advanced to 57.3 in February, hitting its highest level in a year and compared to a reading of 55.5 in January. Additionally, the ADP private sector employment climbed more-than-expected by 183.0K in February, compared to a revised level of 209.0K in the previous month. Moreover, the MBA mortgage applications surged 15.1% on a weekly basis in the week ended 28 February 2020, compared to a rise of 1.5% in the previous week. On the other hand, the final Markit services PMI dropped to a level of 49.4 in February, compared to a level of 53.4 in the prior month. The preliminary figures had also indicated a fall to 49.4.

Separately, the US Federal Reserve (Fed), in its latest Beige Book report, revealed that the US economic activity expanded at a “modest to moderate” pace in majority of the Fed districts. However, two districts namely St. Louis and Kansas City, reported unchanged growth. The report indicated that the coronavirus was negatively impacting travel and tourism in the US, with growth in tourism described as flat to modest. On the outlook front, the Beige Book indicated that the coronavirus and the upcoming presidential elections pose significant risks to the country’s economic outlook.

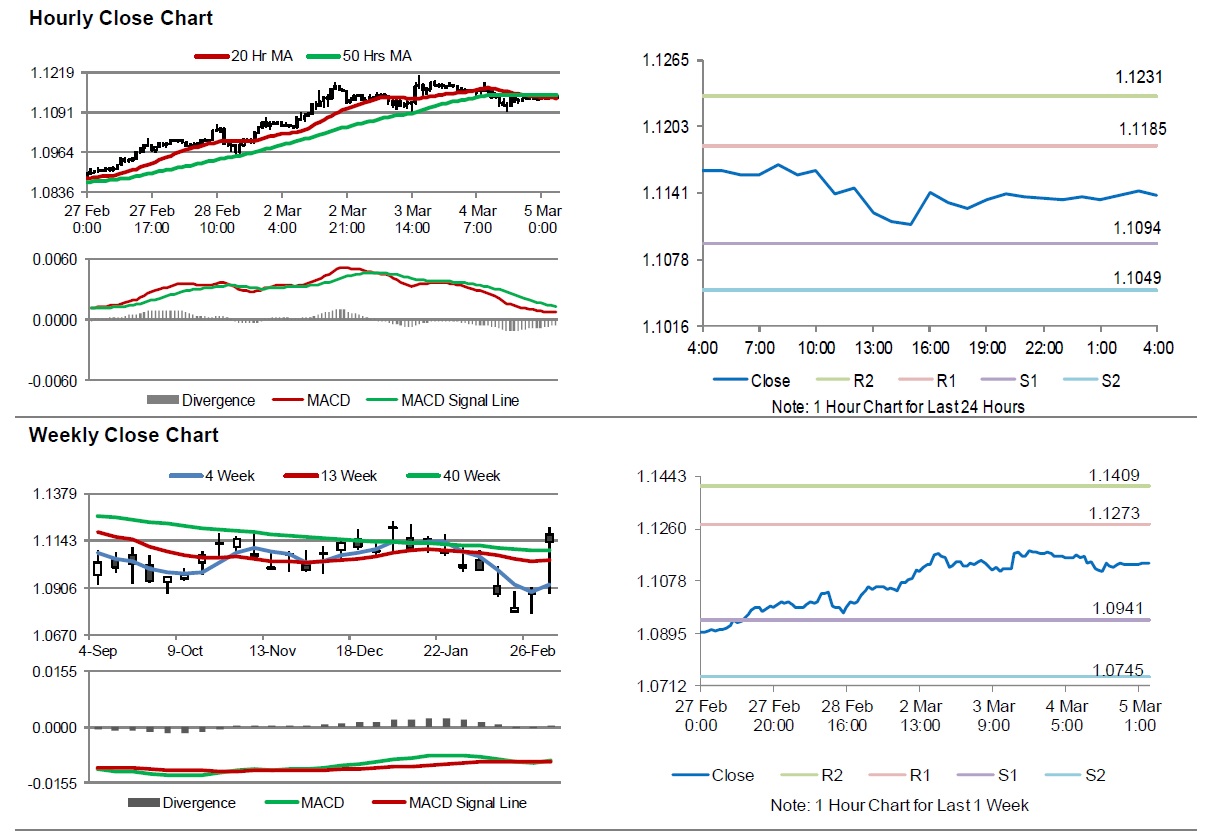

In the Asian session, at GMT0400, the pair is trading at 1.1138, with the EUR trading slightly higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1094, and a fall through could take it to the next support level of 1.1049. The pair is expected to find its first resistance at 1.1185, and a rise through could take it to the next resistance level of 1.1231.

In absence of key macroeconomic releases in the Euro-zone today, investors would direct their attention to the US factory orders and durable goods orders, both for January, along with initial jobless claims, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.