For the 24 hours to 23:00 GMT, the EUR rose 0.12% against the USD and closed at 1.0679, following the release of upbeat retail sales data.

The Euro-zone’s seasonally adjusted retail sales rose more-than-expected by 0.7% MoM in February, on the back of higher clothing and footwear sales, advancing for the second straight month and dispelling concerns that a recent increase in inflation have put a damper on the region’s consumer spending. Retail sales had recorded a revised advance of 0.1% in the previous month, while market participants expected for a gain of 0.5%.

In economic news, data showed that trade deficit in the US narrowed more-than-anticipated to a level of $43.6 billion in February, as exports increased to a two-year high and imports from China plunged. Markets expected the nation’s trade deficit to narrow to a level of $44.6 billion, following a revised deficit of $48.2 billion in the previous month. Also, the nation’s factory orders grew for a third straight month, after it recorded a rise of 1.0% in February, at par with market expectations. In the prior month, factory orders had advanced by a revised 1.5%. Further, the nation’s final durable goods orders climbed more-than-anticipated by 1.8% in February, revised slightly higher from a flash print of 1.7% and compared to a revised rise of 2.3% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0677, with the EUR trading marginally lower against the USD from yesterday’s close.

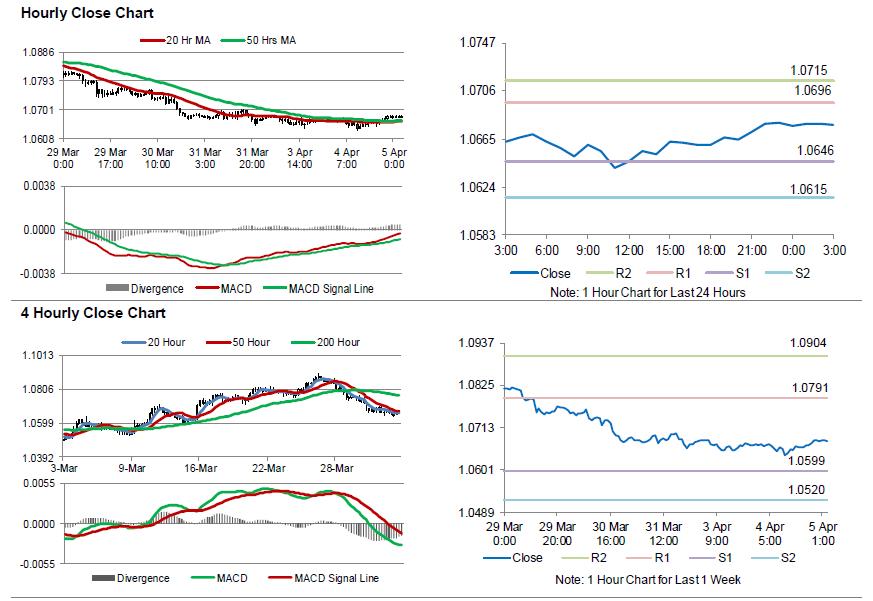

The pair is expected to find support at 1.0646, and a fall through could take it to the next support level of 1.0615. The pair is expected to find its first resistance at 1.0696, and a rise through could take it to the next resistance level of 1.0715.

Going ahead, investors will look forward to the final Markit services PMI for March across the Euro-zone, slated to release in a few hours. Additionally, the US ISM non-manufacturing and the Markit services PMI’s as well as the ADP employment change data, all for March, scheduled to release later in the day, will garner a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.