For the 24 hours to 23:00 GMT, the EUR declined 0.54% against the USD and closed at 1.1968, after Germany’s factory orders surprised with an unexpected drop in November.

On the macro front, Germany’s seasonally adjusted factory orders unexpectedly fell 0.4% on a monthly basis in November, declining for the first time in 4 months and defying market expectations for a flat reading. In the prior month, factory orders had climbed by a revised 0.7%.

Separately, the Euro-zone’s seasonally adjusted retail sales rebounded more-than-expected by 1.5% on a monthly basis in November, rising at its fastest pace in over a year, indicating that an upturn in the region’s consumer spending may be on the horizon. In the previous month, retail sales had dropped 1.1%, while markets had expected for a rise of 1.3%. Moreover, the region’s Sentix investor confidence index climbed to a level of 32.9 in January, topping market consensus for a rise to a level of 31.3, thus highlighting that optimism over the region’s economic outlook continued at the start of the year. The index had registered a level of 31.1 in the previous month.

Other data showed that the region’s final consumer confidence index was confirmed at a 17-year high level of 0.5 in December, compared to a revised flat reading in the previous month. Additionally, the region’s economic sentiment indicator jumped to a level of 116.0 in December, reaching its highest level since October 2000, as strong economic performance across the common currency region continued to boost confidence amongst businesses and consumers. Markets had anticipated the index to advance to a level of 114.8, after recording a reading of 114.6 in the previous month.

The US Dollar advanced against its key currencies, after remarks from several top Federal Reserve (Fed) officials suggested that at least three interest rate hikes were on the table this year.

In economic news, data indicated that consumer credit in the US rose $27.95 billion in November, posting its largest increase in 16 years. Markets participants had expected consumer credit to rise by $18.0 billion, after recording a revised increase of $20.53 billion in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1972, with the EUR trading a tad higher against the USD from yesterday’s close.

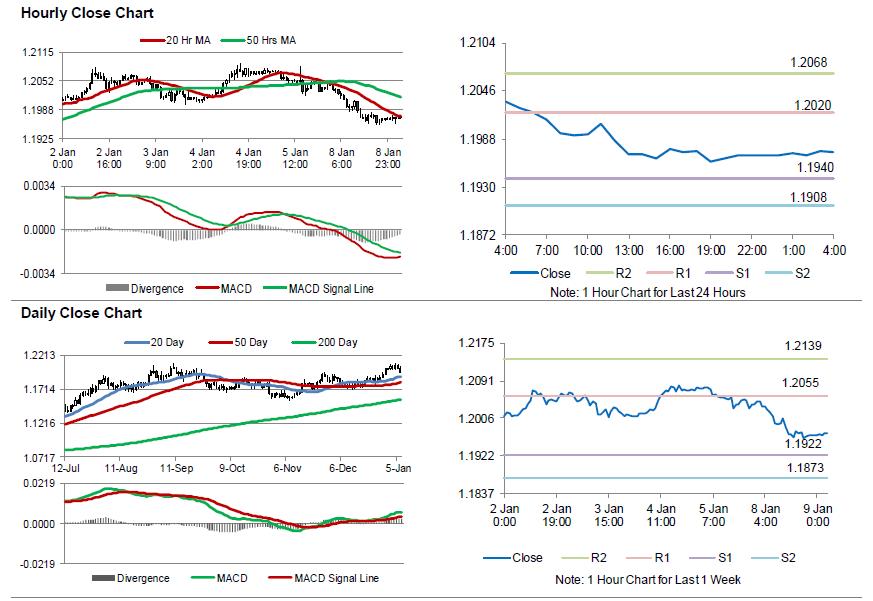

The pair is expected to find support at 1.1940, and a fall through could take it to the next support level of 1.1908. The pair is expected to find its first resistance at 1.2020, and a rise through could take it to the next resistance level of 1.2068.

Trading trend in the Euro today is expected to be determined by the release of the Euro-zone’s unemployment rate coupled with Germany’s trade balance and industrial production data, all for November, set to release in a few hours. Also, the US NFIB small business optimism index for December and JOLTs job openings for November, both due to release later in the day, would be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.