For the 24 hours to 23:00 GMT, the EUR rose 0.24% against the USD and closed at 1.1878, boosted by better-than-expected retail sales data from the Euro-bloc.

The Euro-zone’s seasonally adjusted retail sales unexpectedly advanced 0.5% on a monthly basis in June, suggesting that households ramped-up spending amid optimism that the region’s economy is on a stronger growth path. Retail sales registered a rise of 0.4% in the previous month, while markets were expecting it to record a flat reading. Meanwhile, the region’s final Markit services PMI remained unchanged at a level of 55.4 in July, in line with the flash estimates.

Separately, Germany’s services sector activity fell more than initially estimated to a level of 53.1 in July, compared to a preliminary print that had indicated a drop to a level of 53.5. In the previous month, the PMI had recorded a reading of 54.0.

The greenback lost ground against a basket of major currencies, following worse-than-expected US ISM non-manufacturing data.

The US ISM non-manufacturing PMI declined more-than-expected to a level of 53.9 in July, dipping to an eleven-month low level, thus highlighting a loss of momentum in the nation’s dominant services sector. Markets had expected the PMI to fall to a level of 56.9, compared to a reading of 57.4 posted in the previous month.

On the contrary, the nation’s seasonally adjusted initial jobless claims fell more-than-anticipated to a level of 240.0K in the week ended 29 July, pointing to a healthier labour market, compared to market expectations of a drop to a level of 243.0K. In the prior week, initial jobless claims had recorded a revised reading of 245.0K. Further, the nation’s final Markit services PMI unexpectedly rose to a level 54.7 in July, while investors had envisaged it to remain steady at a level of 54.2 registered in the preliminary figures. In the previous month, the PMI had recorded a reading of 54.2.

Another set of data revealed that final durable goods orders in the US climbed 6.4% in June, revised from a flash print indicating a gain of 6.5%. Durable goods orders had fallen by a revised 0.1% in the previous month. Moreover, the nation’s factory orders rebounded 3.0% in June, meeting market expectations. In the prior month, factory orders had dropped by a revised 0.3%.

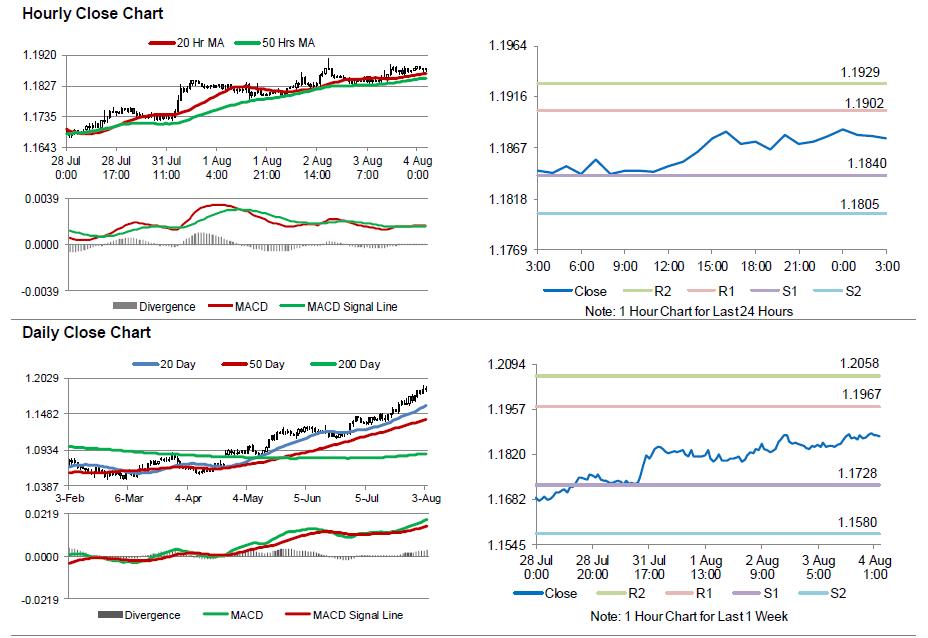

In the Asian session, at GMT0300, the pair is trading at 1.1876, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1840, and a fall through could take it to the next support level of 1.1805. The pair is expected to find its first resistance at 1.1902, and a rise through could take it to the next resistance level of 1.1929.

Moving ahead, investors will keep a close watch on Germany’s factory orders for June, slated to release in a while. Later in the day, all eyes will be on the crucial US non-farm payrolls and unemployment rate data, both for July, followed by the nation’s trade balance figures for June.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.