For the 24 hours to 23:00 GMT, the EUR declined 0.41% against the USD and closed at 1.0905. amid geopolitical tension between U.S and China.

On the macro front, Euro-zone’s Markit manufacturing PMI dropped to 33.4 in April, compared to a level of 44.5 in the prior month. The preliminary figures had recorded a drop to 33.60. Meanwhile, the Sentix investor confidence index slightly rose to -41.8 in May, compared to a reading of -42.9 in the earlier month. Separately, Germany’s Markit manufacturing PMI fell to 34.5 in April, marking its lowest level since March 2009 and compared to a level of 45.4 in the previous month. The preliminary figures had recorded a level of 34.4.

In the US, factory orders plunged 10.3% on a monthly basis in March, more than market forecast for a drop of 9.7% and compared to a revised fall of 0.1% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.0909, with the EUR trading slightly higher against the USD from yesterday’s close.

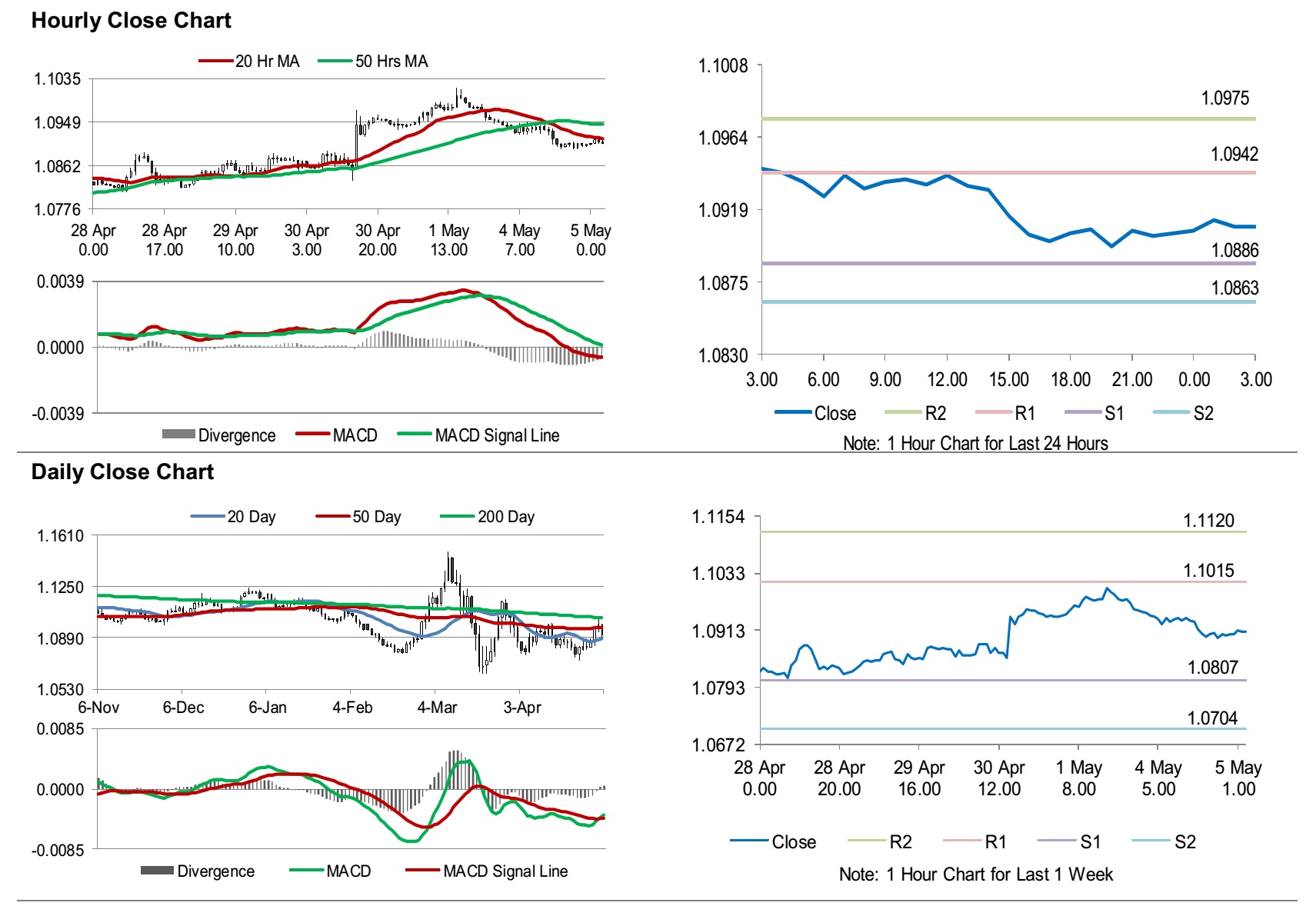

The pair is expected to find support at 1.0886, and a fall through could take it to the next support level of 1.0863. The pair is expected to find its first resistance at 1.0942, and a rise through could take it to the next resistance level of 1.0975.

Moving ahead, investors would keep a watch on Euro-zone’s producer price index for March, slated to release in a few hours. Later in the day, the US trade balance for March along with the Markit services PMI and the ISM non-manufacturing PMI, both for April and the IBD/TIPP economic optimism index for May, would keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.