For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.1328.

In economic news, Euro-zone’s Sentix investor confidence index fell to a level of -3.3 in June, surpassing market expectations for a drop to a level of 2.5. The index had registered a level of 5.3 in the prior month.

In the US, data showed that the NFIB small business optimism index unexpectedly advanced to a 7-month high level of 105.0 in May, defying market consensus for a decline to a level of 102.0. In the preceding month, the index had recorded a level of 103.5. Moreover, the nation’s producer price index (PPI) climbed 1.8% on a yearly basis May, rising at its weakest pace in a year and compared to a gain of 2.2% in the previous month. Market participants had envisaged the PPI to record a rise of 2.0%.

In the Asian session, at GMT0300, the pair is trading at 1.1330, with the EUR trading slightly higher against the USD from yesterday’s close.

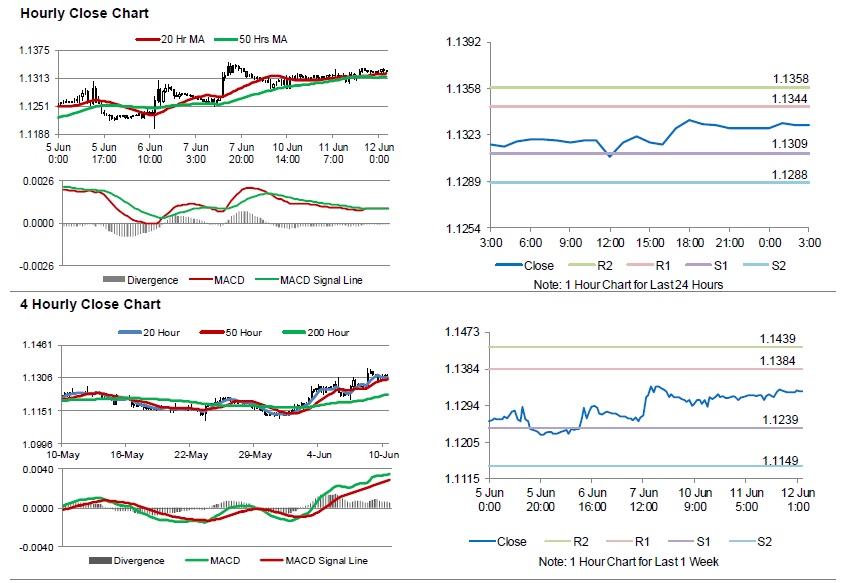

The pair is expected to find support at 1.1309, and a fall through could take it to the next support level of 1.1288. The pair is expected to find its first resistance at 1.1344, and a rise through could take it to the next resistance level of 1.1358.

Amid lack of macroeconomic releases in Euro-zone today, investors will focus on the US consumer price index for May along with MBA mortgage applications, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.