For the 24 hours to 23:00 GMT, the EUR declined 0.34% against the USD and closed at 1.1925, following a deterioration in the Euro-zone’s investor confidence.

The Euro-zone’s Sentix investor confidence index unexpectedly dropped to a 15-month low level of 19.2 in May, defying market consensus for a rise to a level of 21.0. The index had registered a level of 19.6 in the previous month.

Meanwhile, Germany’s seasonally adjusted factory orders surprisingly fell 0.9% on a monthly basis in March, confounding market expectations for a rise of 0.5%. Factory orders had dropped by a revised 0.2% in the previous month.

On Friday, data indicated that the Euro-zone’s seasonally adjusted retail sales posted a modest gain of 0.1% on a monthly basis in March, compared to a revised gain of 0.3% in the previous month, while markets were anticipating for a rise of 0.5%. On the other hand, the region’s final Markit services PMI unexpectedly dropped to a level of 54.7 in April, while the preliminary figures had indicated an advance to a level of 55.0. The PMI had registered a level of 54.9 in the prior month.

Separately, Germany’s final Markit services PMI surprisingly eased to a level of 53.0 in April, compared to a flash estimate that had indicated an increase to a level of 54.1. In the previous month, the PMI had recorded a reading of 53.9.

In the US, data released on Friday showed that non-farm payrolls rose by 164.0K in April, undershooting market expectations for an advance of 193.0K. Non-farm payrolls had recorded a revised increase of 135.0K in the previous month. Moreover, the nation’s average hourly earnings of all employees climbed less-than-anticipated by 0.1% MoM in April, compared to market consensus for a rise of 0.2%. Average hourly earnings of all employees had recorded a revised rise of 0.2% in the prior month.

Nevertheless, the nation’s unemployment rate fell more-than-expected to 3.9% in April, hitting a more than 17-year low and following a reading of 4.1% in the previous month. Market participants had envisaged unemployment rate to ease to 4.0%.

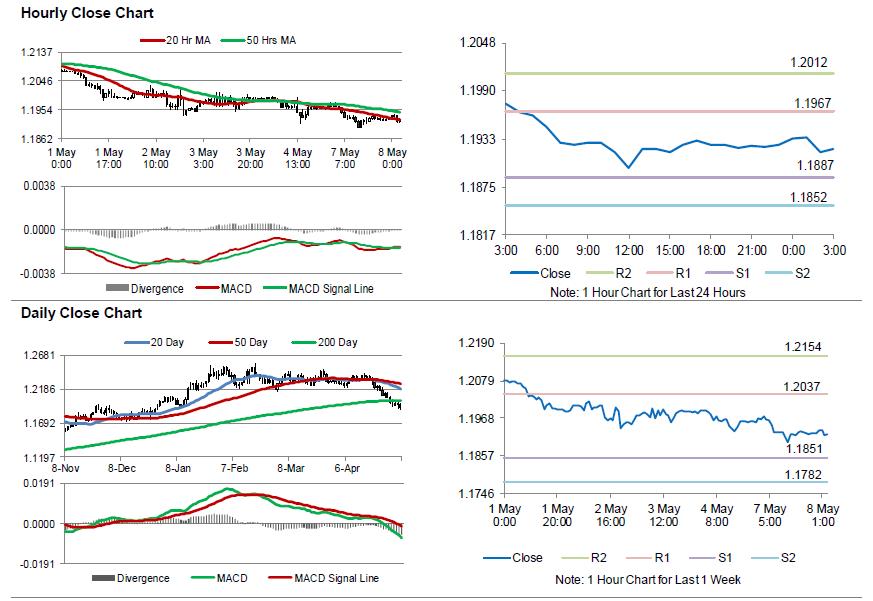

In the Asian session, at GMT0300, the pair is trading at 1.1921, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1887, and a fall through could take it to the next support level of 1.1852. The pair is expected to find its first resistance at 1.1967, and a rise through could take it to the next resistance level of 1.2012.

Going ahead, traders would focus on Germany’s trade balance and industrial production data for March, both slated to release in a few hours. Additionally, a speech by the US Federal Reserve Chairman, Jerome Powell, due later in the day, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.