For the 24 hours to 23:00 GMT, the EUR rose 0.35% against the USD and closed at 1.1243.

On the macro front, the Euro-zone’s final services PMI unexpectedly climbed to a level of 53.3 in March, compared to a level of 52.8 in the previous month. The preliminary figures and market participants had envisaged the PMI to drop to a level of 52.7. Moreover, the region’s seasonally adjusted retail sales advanced 2.8% on a yearly basis in February, surpassing market expectations for a rise of 1.5%. In the previous month, retail sales had recorded a gain of 2.2%. Separately, in Germany, the final services PMI surprisingly rose to a level of 55.4 in March, defying market anticipations for a fall to a level of 54.9. The PMI had registered a reading of 55.3 in the prior month, while preliminary figures had recorded a decline to a level of 54.9.

The US dollar declined against its major currencies yesterday, amid weak US jobs data.

In the US, data indicated that the ADP private sector employment growth slowed to an 18-month low level by 129.0K in March, following a revised rise of 197.0K in the preceding month. Market participants had anticipated the private sector employment to advance to 180.0K. Further, the final Markit services PMI fell to a level of 55.3 in March, notching a 19-month low level and compared to a reading of 56.0 in the previous month. The preliminary figures and market participants had expected the PMI to ease to a level of 54.8. Moreover, the nation’s ISM non-manufacturing PMI declined to a level of 56.1 in March, marking its weakest level since mid-2017 and compared to a level of 59.7 in the previous month. Markets had expected the PMI to fall to a level of 58.0. On the contrary, the MBA mortgage applications rallied to a 2.5-year high level of 18.6% on a weekly basis in the week ended 29 March 2019, boosted by gains in refinancing activity and following a rise of 8.9% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1238, with the EUR trading a tad lower against the USD from yesterday’s close.

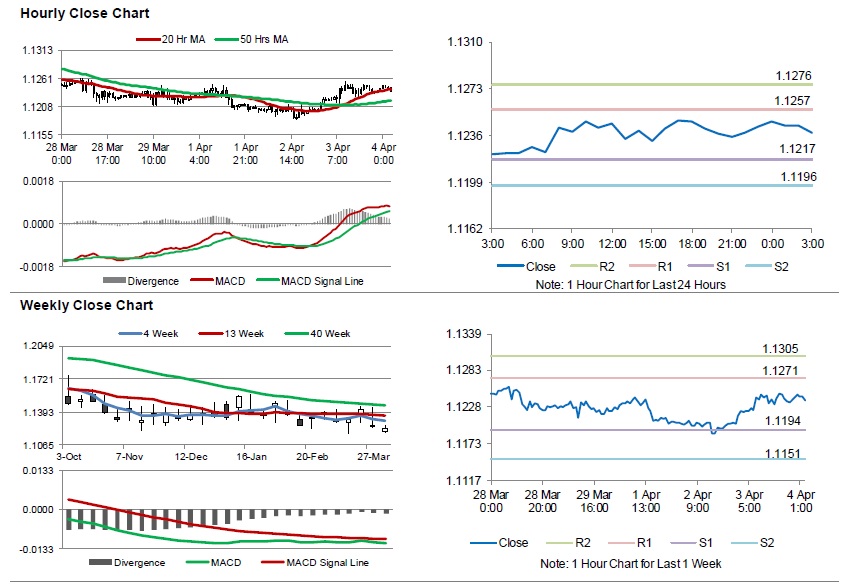

The pair is expected to find support at 1.1217, and a fall through could take it to the next support level of 1.1196. The pair is expected to find its first resistance at 1.1257, and a rise through could take it to the next resistance level of 1.1276.

Moving ahead, traders would closely monitor Germany’s factory orders for February and the Markit construction PMI for March, set to release in a few hours. Later in the day, the US initial jobless claims, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.