For the 24 hours to 23:00 GMT, the EUR rose 0.15% against the USD and closed at 1.1760, after the Euro-zone’s final Markit services PMI was surprisingly revised up to a level of 55.8 in September, while the preliminary print had indicated an advance to a level of 55.6, suggesting that manufacturing sector will remain a key pillar of growth in the common currency region. In the prior month, the PMI had registered a level of 54.7.

On the contrary, the region’s seasonally adjusted retail sales recorded an unexpected drop of 0.5% on a monthly basis in August, declining for the second straight month and confounding market consensus for a gain of 0.3%. In the prior month, retail sales had dropped 0.3%.

Separately, Germany’s final Markit services PMI climbed to a level of 55.6 in September, confirming the flash estimate. The PMI had registered a reading of 53.5 in the previous month.

The US Dollar recouped some of its earlier losses against a basket of major currencies, following an upbeat report on the US services sector.

Data showed that the US ISM non-manufacturing activity index jumped more-than-anticipated to a level of 59.8 in September, accelerating at its fastest clip in 12 years, thus indicating that the sector has shown strong resilience to last month’s hurricane disruptions. The PMI had recorded a level of 55.3 in the prior month, while market participants had envisaged for a rise to a level of 55.5.

Other data showed that ADP’s private sector employment in the US climbed by 135.0K in September, at par with market expectations. However, it was the weakest reading in thirteen months as distortions caused by a pair of hurricanes weighed on the nation’s job market. The private sector employment had registered a revised increase of 228.0K in the prior month. Further, the nation’s final Markit services PMI eased more than initially estimated to a level of 55.3 in September, compared to a drop to a level of 55.1 recorded in the preliminary figures. In the previous month, the PMI had recorded a level of 56.0. Also, the nation’s mortgage applications eased 0.4% in the week ended 29 September, after recording a fall of 0.5% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1758, with the EUR trading a tad lower against the USD from yesterday’s close.

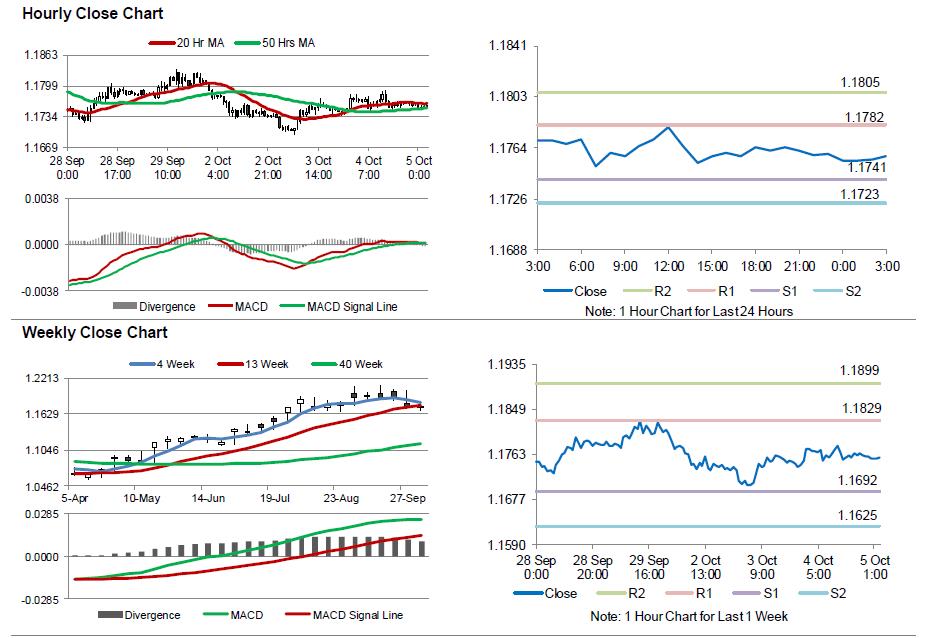

The pair is expected to find support at 1.1741, and a fall through could take it to the next support level of 1.1723. The pair is expected to find its first resistance at 1.1782, and a rise through could take it to the next resistance level of 1.1805.

Looking forward, investors will keep a close watch on the minutes of the European Central Bank’s September policy meeting, due to release later in the day. Moreover, the US initial jobless claims data followed by the nation’s trade balance, factory orders and final durable goods orders, all for August, set to release later today, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.