For the 24 hours to 23:00 GMT, the EUR marginally rose against the USD and closed at 1.0766 on Friday.

In economic news, the Euro-zone’s final Markit services PMI was surprisingly revised upwards to a level of 53.7 in January, defying market expectations for the PMI to remain steady at a level of 53.6, recorded in the flash estimate. In the previous month, the PMI registered a level of 53.7. In contrast, the region’s retail sales unexpectedly dropped 0.3% on a monthly basis in December, declining for the second straight month and confounding market consensus for a rise of 0.3%. In the prior month, retail sales had dropped by a revised 0.6%.

Separately, Germany’s services sector growth slightly advanced to a level of 53.4 in January, while investors had envisaged the PMI to record an unchanged reading of 53.2, registered in the preliminary print. In the prior month, the PMI had recorded a level of 54.3.

The US Dollar traded mixed against a basket of major currencies on Friday, after robust US non-farm payrolls data was marred by disappointing wage growth.

Non-farm payrolls data indicated that the US economy added 227.0K jobs in January, adding the most number of jobs in four-months and surpassing market consensus for an advance of 180.0K. Non-farm payrolls had registered a revised increase of 157.0K in the prior month. On the contrary, the nation’s average hourly earnings of all employees rose less-than-expected by 0.1% on a monthly basis in January, compared to market expectations for a gain of 0.3% and after recording a revised rise of 0.2% in the previous month. Also, the nation’s unemployment rate ticked up to 4.8% in January, while market participants anticipated it to remain unchanged at 4.7%, as recorded in the previous month.

Another set of data showed that the US ISM non-manufacturing PMI unexpectedly eased to a level of 56.5 in January, compared to a revised reading of 56.6 in the prior month, while markets were anticipating the PMI to rise to a level of 57.0. Further, the nation’s final durable goods orders fell 0.5% in December, after recording a drop of 4.8% in the previous month, while the preliminary figures had recorded a fall of 0.4%. On the other hand, the nation’s final Markit services PMI climbed to a level of 55.6 in January, against a preliminary print of 55.1 and following a reading of 53.9 in the previous month. Additionally, the nation’s factory orders rebounded 1.3% in December, more than market anticipations for an advance of 0.5%. In the prior month, factory orders had dropped by a revised 2.3%.

In the Asian session, at GMT0400, the pair is trading at 1.0780, with the EUR trading 0.13% higher against the USD from Friday’s close.

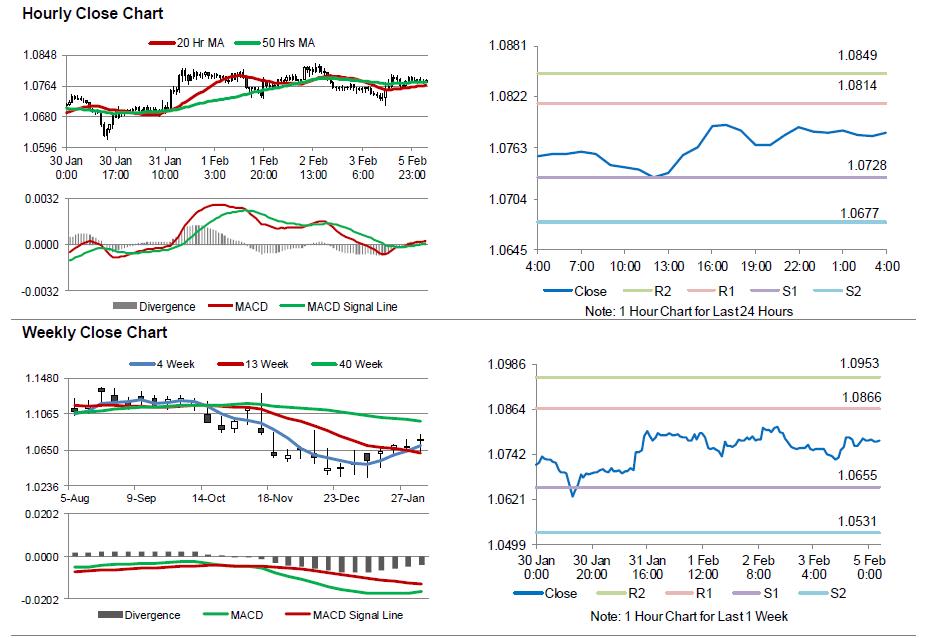

The pair is expected to find support at 1.0728, and a fall through could take it to the next support level of 1.0677. The pair is expected to find its first resistance at 1.0814, and a rise through could take it to the next resistance level of 1.0849.

Moving ahead, market participants will focus on the Euro-zone’s Sentix investor confidence index for February and Germany’s factory orders data for December, due to release in a few hours. Also, a speech by the ECB President, Mario Draghi, scheduled later in the day, will be eyed by traders. In addition to this, the US labour market conditions index for January, will also be on investor’s radar.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.